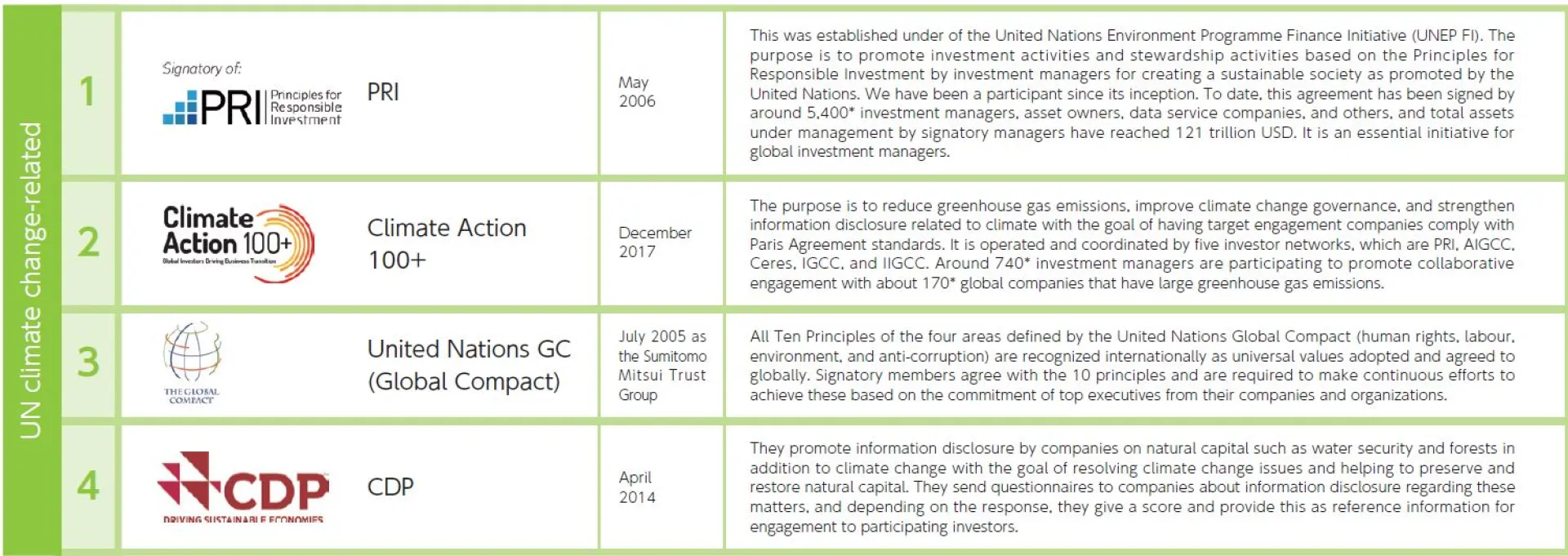

SuMi TRUST AM has long believed that responding to ESG issues is an integral part of the investment process. As a committed responsible investor we launched our first SRI (Socially Responsible Investment) fund in 2003 and were one of the founding signatories of the UN Principles for Responsible Investment (PRI) in 2006.

We regard stewardship activities such as engaging with companies and exercising voting rights as vital to addressing ESG challenges. Ultimately aiming to improve corporate value of investee companies and enabling us to meet our responsibility to expand investment returns for our clients as part of our stewardship responsibilities.

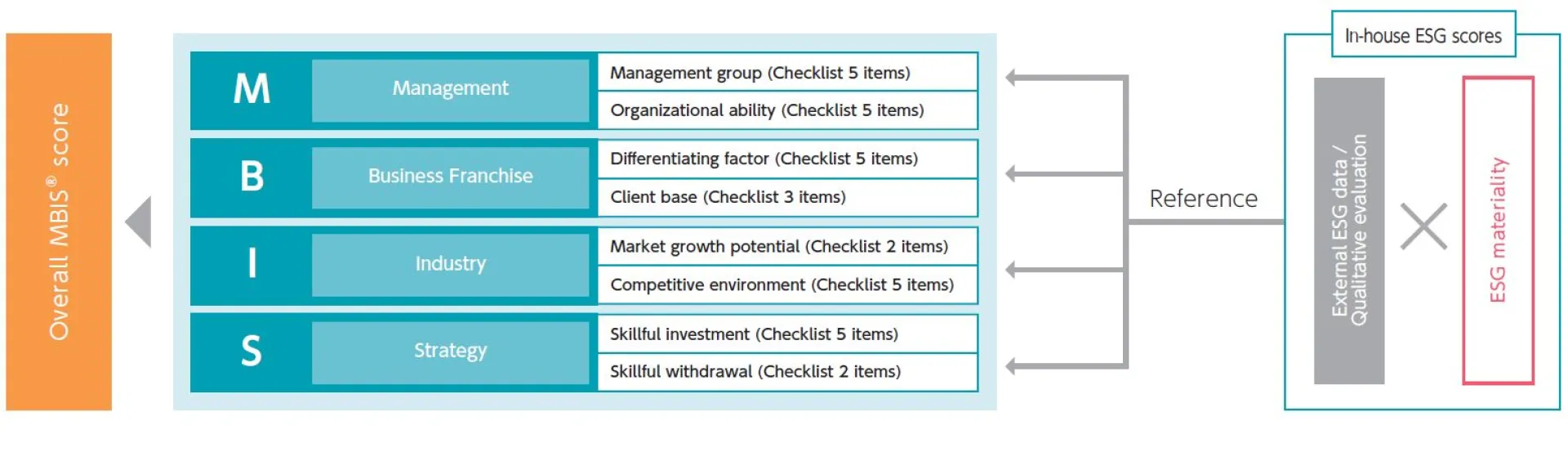

In addition to financial information such as corporate earnings, we believe non-financial information including ESG initiatives and sustainability of added value for a company’s products and services can have a significant impact on corporate value over time. In April 2015, as a mechanism for looking carefully at the “earnings power” of companies, we introduced MBIS®, an in-house-developed tool for analyzing and evaluating ESG and other non-financial information.

MBIS® is an acronym which stands for Management (M), Business Franchise (B), Industry (I) and Strategy (S).

Milestones in Our ESG Activities

Establishes Japan Quality Growth Fund.

Starts incorporating the ESG concepts into the "business risk assessment" for corporate bond investment.

Wins the Award for Excellence in Sustainable Finance※3 at the 2015 Sustainable Finance Awards.※2

Establishes a dedicated department for stewardship activities.

Adopts the revised Japan’s Stewardship Code.

Establishes the Stewardship Development Department.

Bloomberg MSCI Global Aggregate Sustainability A+ Index-Linked Setting (Bonds)

Started high-return, low-beta strategy (Japanese equity, ESG consideration type) for pension trust

※1 Our activities up to September 2018 also include those conducted by Sumitomo Mitsui Trust Bank, Limited.

※2 awarded by the Research Institute for Environmental Finance (Annually).

※3 "ESG integration into domestic active management"

※4 "Global engagement activities based on international norms and rules"

MBIS®: Our Non-financial Information Evaluation Tool

Our proprietary Management, Business Franchise, Industry and Strategy (MBIS) tool seeks to qualitatively assess non-financial information (ESG information) to evaluate investee companies’ basis for sustainable growth. Drawing on this kind of information, we can evaluate the strengths companies bring and the challenges they face in achieving sustainable growth.

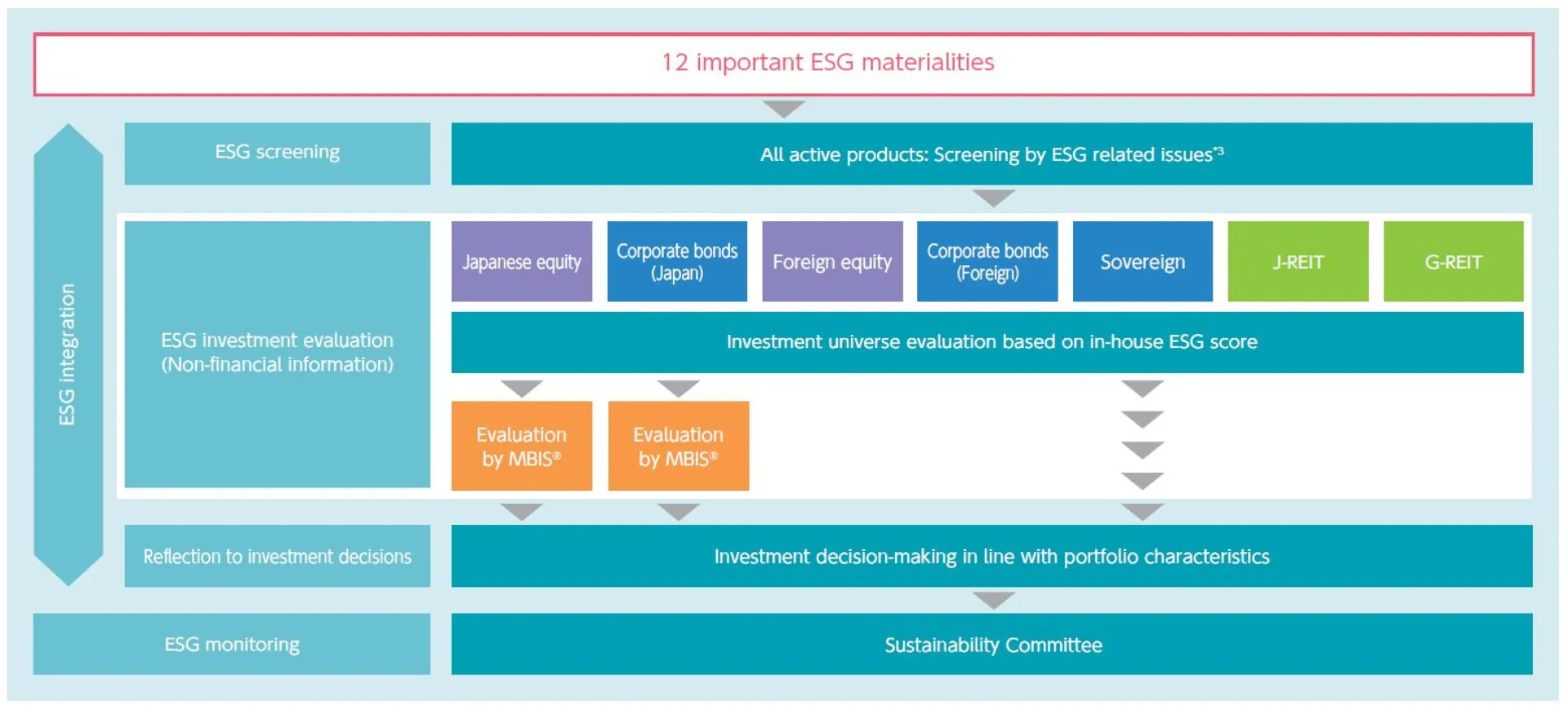

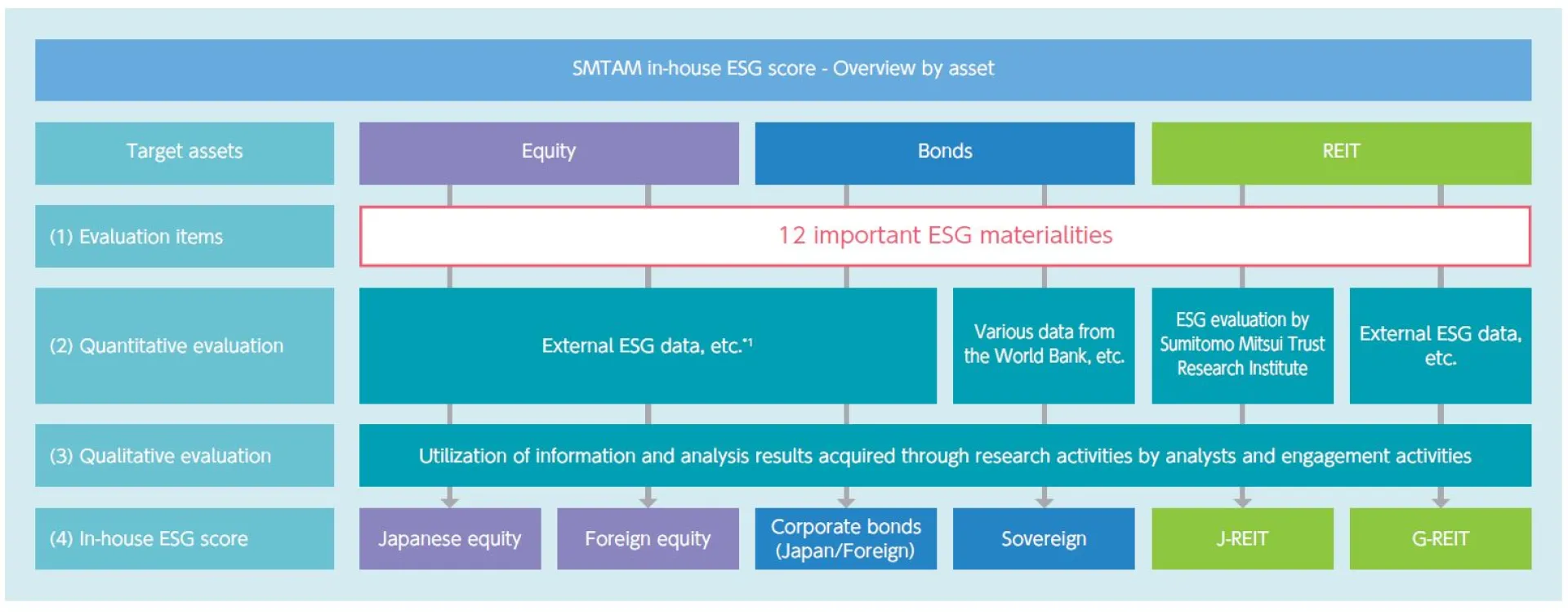

Through our MBIS tool, investee companies’ ESG initiatives are assessed based 12 “ESG materialities” which are described in more detail below. Through these ESG materialities, we strive to ensure ESG initiatives are aligned with the UN’s 17 Sustainable Development Goals

*MBIS® is a registered trademark of Sumitomo Mitsui Trust Bank

Top-Down Engagement

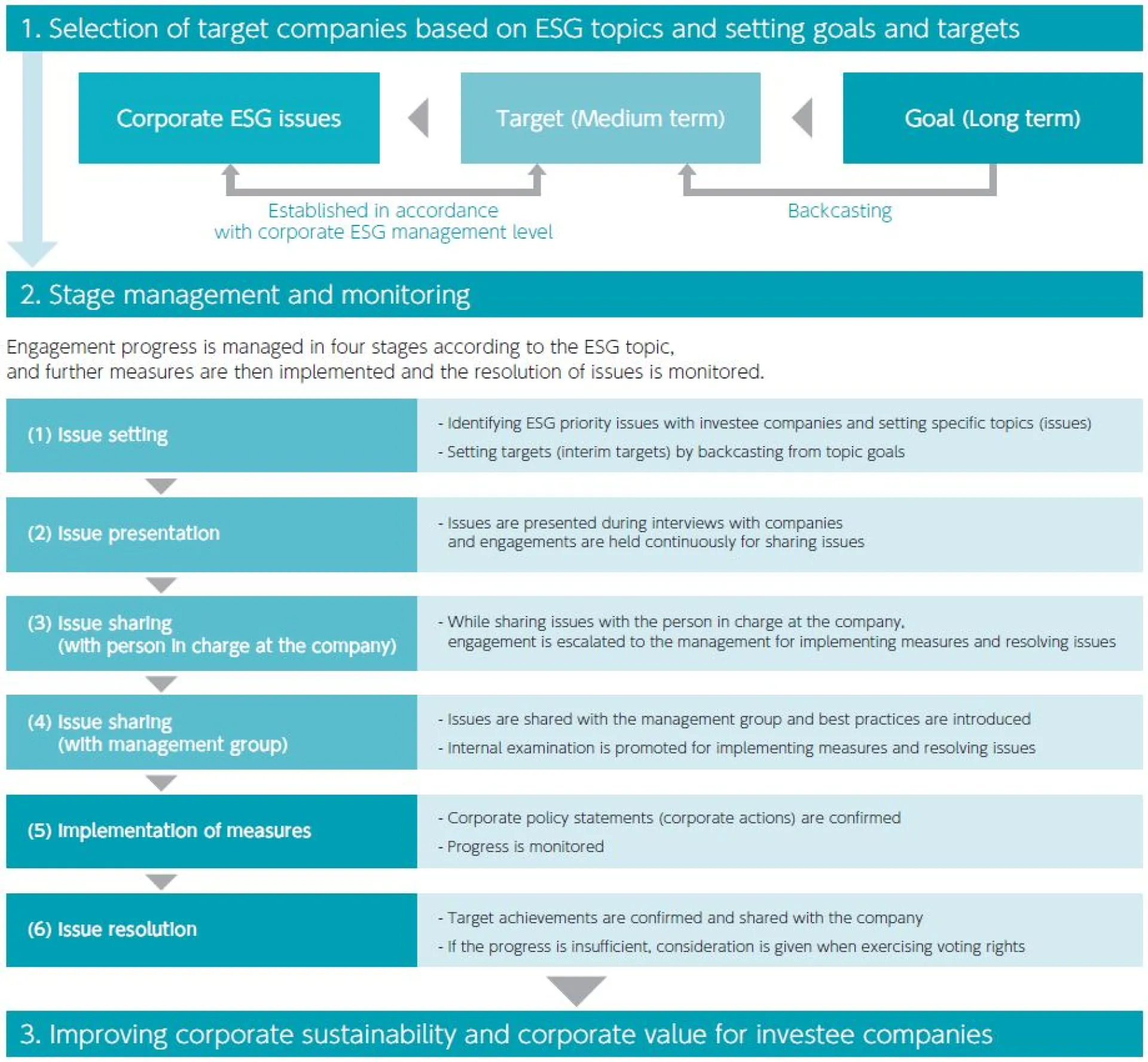

In 2019, an ESG investment policy was established at management meetings and 12 ESG materialities were identified. We are promoting top-down engagement activities in harmony with these. After selecting around 100 target companies from among investee companies via top-down analysis according to each ESG materiality, engagement activities will be promoted by setting goals (long-term goals) linked to each ESG materiality and setting targets (interim targets) by backcasting based on the ESG issues and ESG management level of each company. Effective goals and targets are set, and effective engagement is performed based on our “deep understanding and knowledge about companies and industry trends” that has been accumulated through numerous engagements up until now, and “knowledge on global trends related ESG” gained through Japanese and global initiatives that we are actively participating in from our three offices in Japan, the US, and the UK. The progress status of engagement is managed in four phases according to the ESG materiality targets of each company. After targets are met, monitoring is done for later processes such as implementation of measures and resolution of issues.

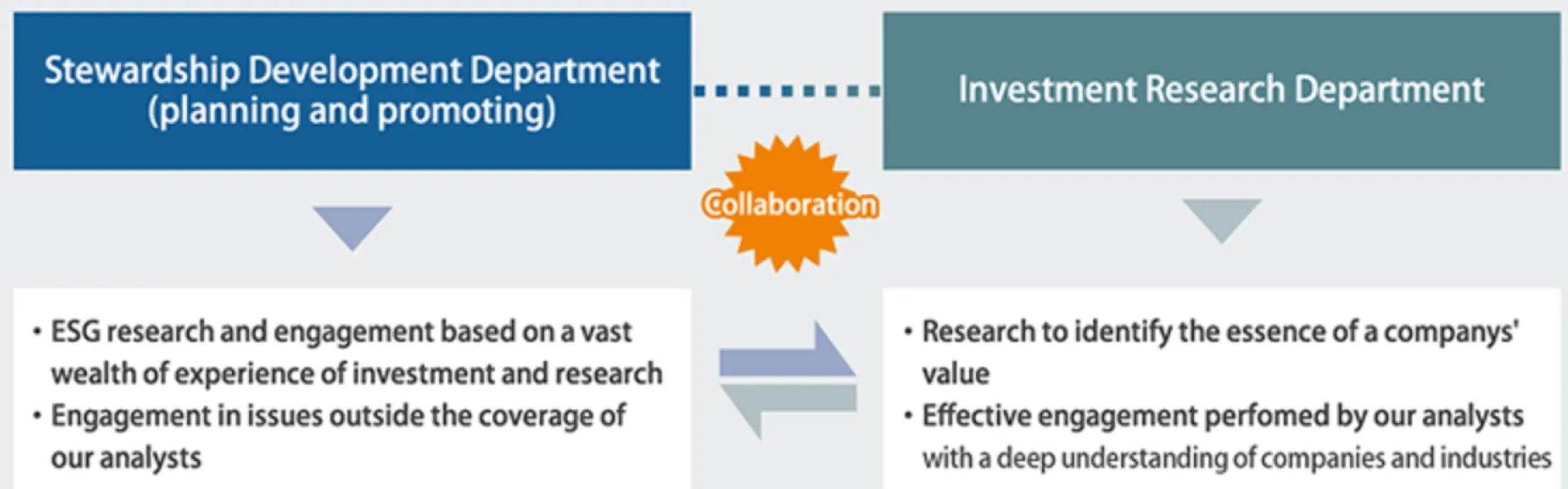

We interact with companies on an individual basis as a general rule. We believe that rigorous research and in-depth understanding of companies go hand in hand with effective engagement, this is why our Investment Research Department (IRD) are directly responsible for engagement with investee companies. They work in tandem with the Stewardship Development Department who cover engagement in issues outside the IRD’s scope

For cases where we cannot confirm post-engagement changes at companies, issues for which institutional investors have formed a shared understanding, medium- to long-term themes, and related situations, we look to harness collective engagement through a program sponsored by Institutional Investors Collective Engagement Forum (IICEF). For cases where we determine collective engagement would encourage changes we participate in IICEF activities.

For details, please visit iicef's website URL: https://www.iicef.jp/en/

ESG Engagement Around the World

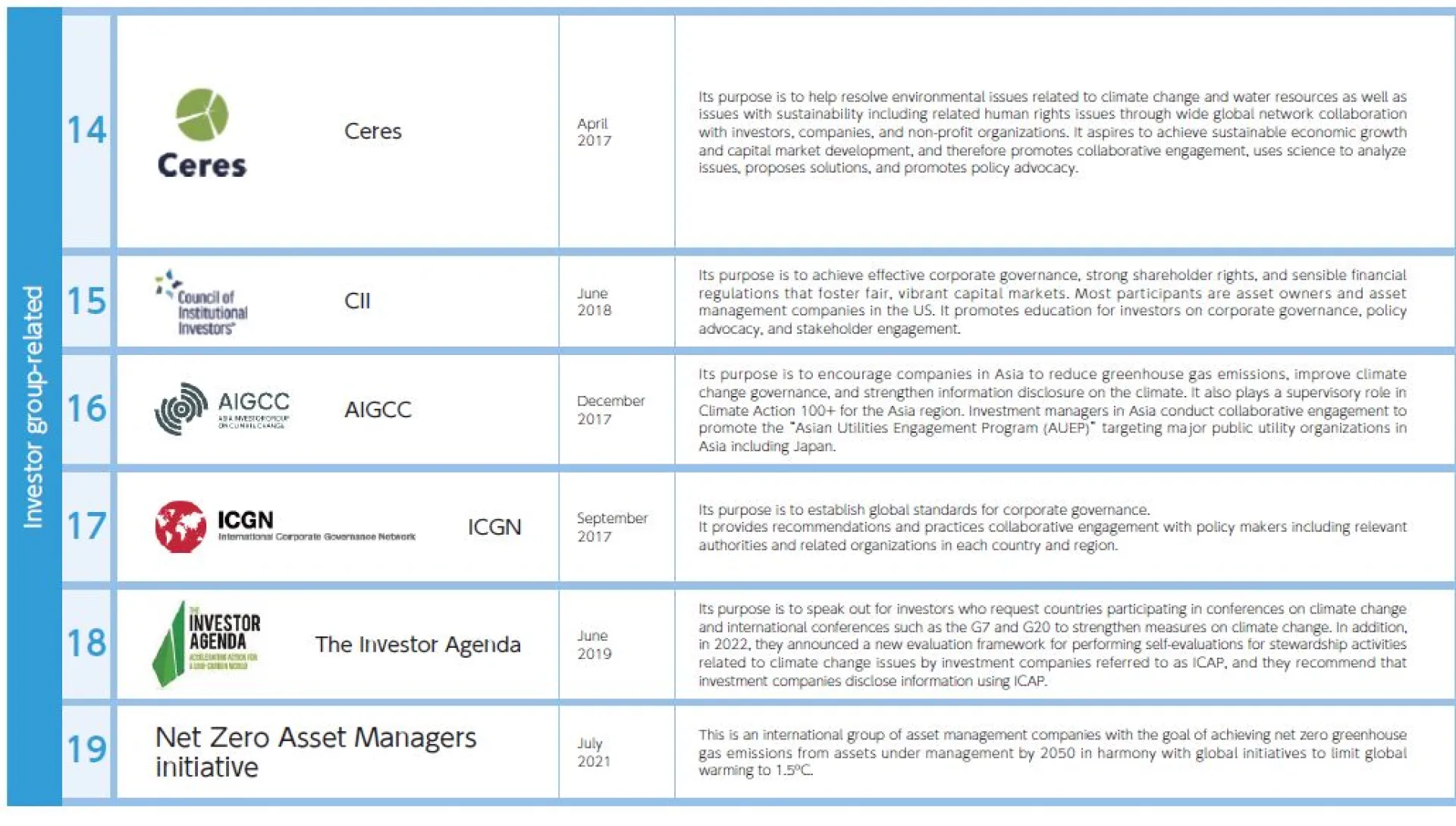

We conduct a variety of engagements on ESG challenges with companies around the world. Our stewardship activities are led by a dedicated team based in Tokyo, the UK and the US, working closely with our credit and equity research analysts. In addition to actively engaging directly with investee companies, we are also proactive signatories to a number of global and domestic ESG initiatives.

Global Initiatives

Domestic Initiatives