Image

News

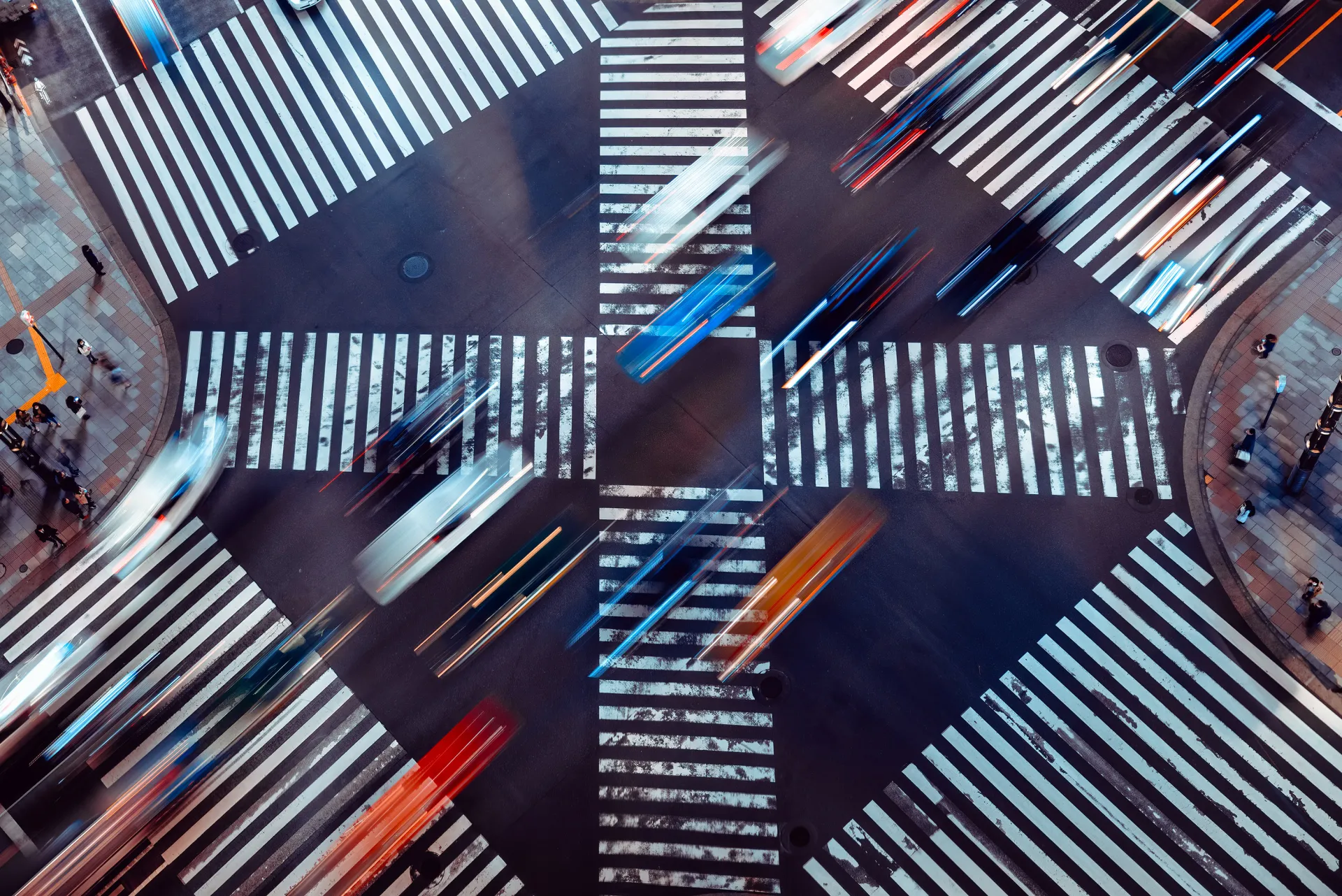

In April, the Japanese equity market experienced a minor rebound after a tough past few months, with the TOPIX and Nikkei 225 indices rising by 0.3% and 1.2% respectively. Major volatility in the market was driven by uncertainty regarding US tariff policy.

Image

News

Tariffs prompt Bank of Japan to lower growth forecasts

Date: 1st May 2025

[External Link] Katsutoshi Inadome, Chief Strategist at SuMi TRUST AM, shared his comments on the outlook for Japan's monetary policy as the Bank of Japan announced it would hold interest rates steady as it revised down its growth forecasts.

Image

News

How to Survive as a Growth Manager in Japan

Date: 25th April 2025

[External Link] In this piece published by Funds Global Asia, Katsunori Ogawa, Chief Portfolio Manager of the Sakigake High Alpha at SuMi TRUST AM, explores why growth investing in Japan remains relevant - even as the market narrative shifts toward value.

Image

News

Julius Baer, SuMi TRUST AM Optimistic On Japanese Equities Despite Tariff Turmoil

Date: 25th April 2025

[External Link] In this piece published by Wealth Briefing, Kazunaga Saso, Senior Portfolio Manager of the Sakigake High Alpha fund at SuMi TRUST AM comments why he is positive about Japan’s economic outlook and stock market, despite sweeping tariffs levied by the US.

Image

News

Market Review for March 2025

Date: 1st April 2025

In March, Japanese equities declined with the TOPIX and Nikkei 225 indices dropping by 0.9% and -4.1%, respectively. The decline was driven by concerns over U.S. President Trump’s tariff proposals, a rising yen, and fears of a global economic slowdown.

Image

News

Bank of Japan holds rates and warns of trade uncertainty

Date: 20th March 2025

[External Link] Katsutoshi Inadome, Chief Strategist at SuMi TRUST AM, shared his comments on the outlook for Japan's monetary policy as the Bank of Japan announced it would make no changes at present.

Image

News

Market Review for February 2025

Date: 3rd March 2025

In February, the Japanese equity market declined with the TOPIX and Nikkei 225 indices dropping by -3.8% and -6.1% respectively. A number of factors including continued concern over President Trump’s tariffs on U.S. imports, failed ceasefire negotiations between Ukraine and Russia, and speculation over further Bank of Japan interest rate hikes led to volatility.

Image

News

Market Review for January 2025

Date: 3rd February 2025

In January, the Japanese equity market saw modest movements, with the TOPIX up by 0.1% and the Nikkei 225 down by 0.8% at the month end. A number of factors including a rate hike by the Bank of Japan, the Fed holding rates in place and setbacks for US AI companies led to some volatility within the month.

Image

News

Market Review for December 2024

Date: 6th January 2025

In December, the Japanese equity market rebounded with the TOPIX and Nikkei 225 indices ending the month up by 3.89% and 4.41% respectively. Despite a US rate cut of 0.25% by the Fed, the Bank of Japan’s dovish stance contributed to the weakening of the yen.

Image

News

Market Review for November 2024

Date: 2nd December 2024

In November, the Japanese market experienced a decline with the TOPIX and Nikkei 225 indices ending the month down by -0.5% and -2.2% respectively due to factors including expectations of a BOJ rate hike and potential upcoming US trade policy changes.