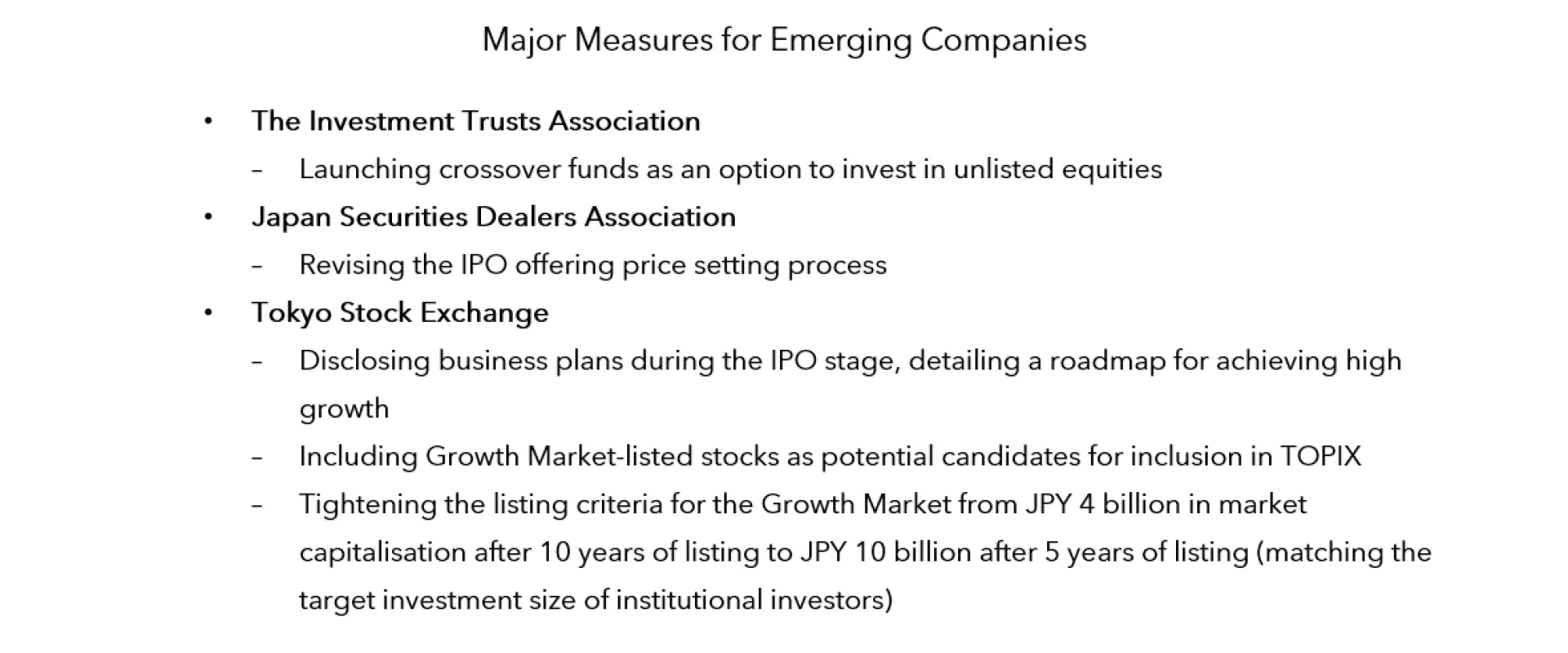

The key points of the improvement measures are as follows:

The first point is to encourage “Management That Strives for High Growth.” There are concerns that start-up companies, after going public, fail to increase their corporate value and treat listing as the ultimate goal, a phenomenon known as the “listing goal” problem. To address this issue, companies will be required to analyse their post-listing growth performance and disclose specific factors and countermeasures if they are not achieving the expected growth. Furthermore, since these disclosures are required to be made at least once a year on an ongoing basis, this is expected to place significant pressure on companies whose post-listing performance is unsatisfactory.

The second point is the revision of the continued listing criteria. The current criteria, which require a market capitalisation of at least 4 billion yen after 10 years of listing, will be significantly raised to a market capitalisation of at least 10 billion yen after five years of listing. Listed companies are expected to place greater emphasis on their stock price (market capitalisation) along with M&A activity. Additionally, the 10-billion-yen market capitalisation threshold is intended to ensure that companies remain attractive investments for institutional investors who can engage with companies and offer suggestions to management and exert influence through the exercise of voting rights in response to poor management. By setting such strict criteria, the TSE aims to raise the overall level of the Growth Market.

With stricter conditions, there is the possibility that the number of IPOs will decrease in the short run due to a wait-and-see attitude. On the other hand, as investor sentiment towards the Growth Market improves, funding opportunities are expected to increase, leading to a higher number of start-ups aiming to list on the Growth Market over the medium term.

Overall Japanese stock market to be more active

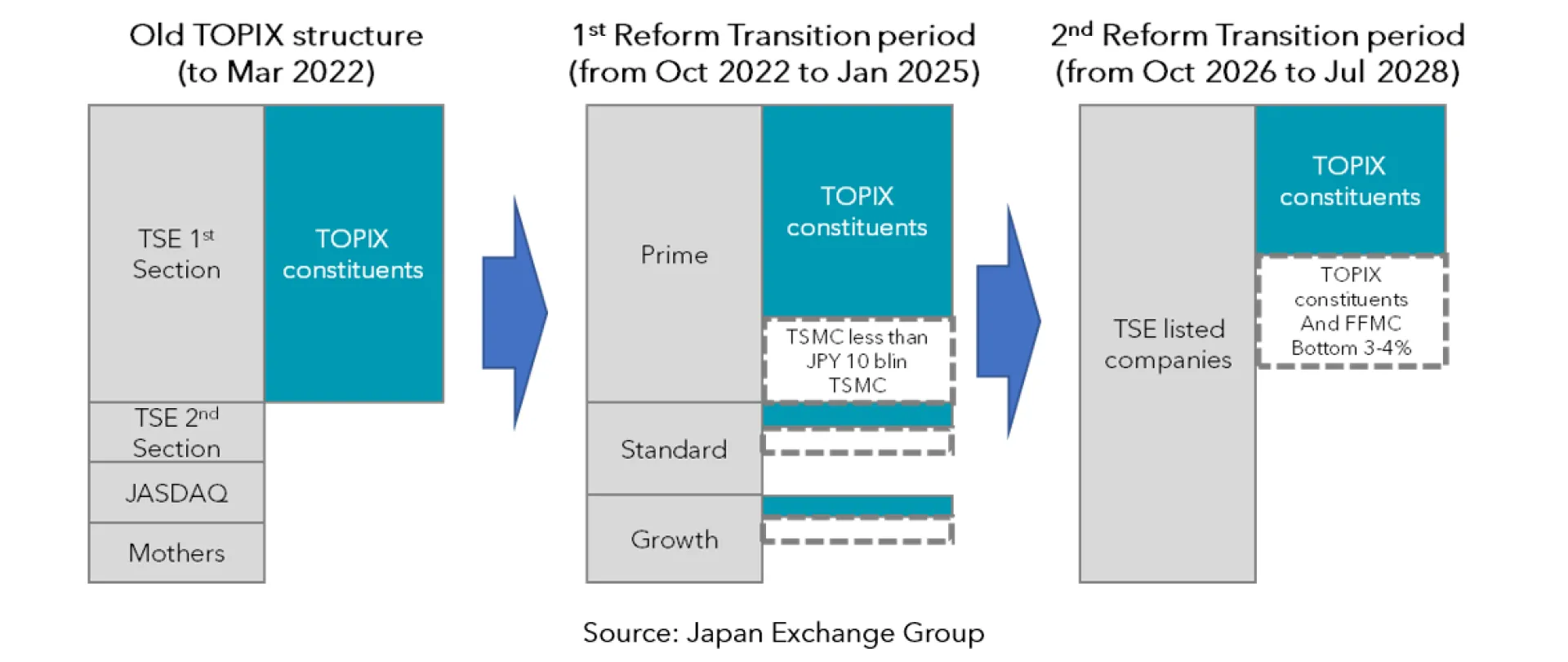

The TSE's measures aimed at improving the Growth Market are expected to contribute to the revitalisation of the Japanese stock market as a whole, particularly for small and mid-sized companies. There are many companies listed on the Prime and Standard Markets whose earnings and share prices have stagnated after going public. With the qualitative improvement of the Growth Market, these companies are likely to face increased pressure and disclosure requirements on their growth potential and will lead to frequent engagement with institutional investors. Looking ahead, all TSE-listed stocks will be subject to review for inclusion in the next-generation TOPIX slated to take place in 2028. Competition to enhance corporate value is expected to intensify as companies aim for inclusion in the new indices, regardless of market division.

It is not only the TSE that is working to promote emerging companies. The government is also relaxing regulations on trading of unlisted shares to foster start-ups. In line with this policy, the Investment Trust Association revised its rules in February 2024 to allow public investment trusts to include a portion in unlisted shares. If the barriers between unlisted and listed markets are removed and the growth of emerging companies is promoted, this would not only enhance the appeal of the growth market but also contribute to the overall attractiveness of Japan's stock market. Going forward, we will continue to closely monitor the collaborative efforts of the government, financial authorities and industry associations to promote the development of the stock market.