Why India?

There have been several positive factors that have made India attract investor attention. The United Nations has estimated that the population of India is now larger than that of China and India has become the most populous country in the world. The country has overtaken the U.K. in gross domestic product (GDP) to become the fifth largest economy in the world, following the U.S., China, Japan and Germany. It is expected to become world’s third largest economy by 2030. Ongoing disputes between the US and China have also contributed to increased investor interest. India is one of potential destinations for China-shy investors seeking Asian exposure and for those realigning global supply-chains away from China.

I have been bullish about the country for some time and India’s growth has become one of the key themes in my portfolio. In this column, I am going to introduce a couple of companies in my portfolio that will benefit from the rise of India. I will start with the overview of opportunities for Japanese companies in India and their experience in the period of China’s rise. Then, I will introduce you to a couple of companies that are well positioned in the country.

India’s Growth Potential

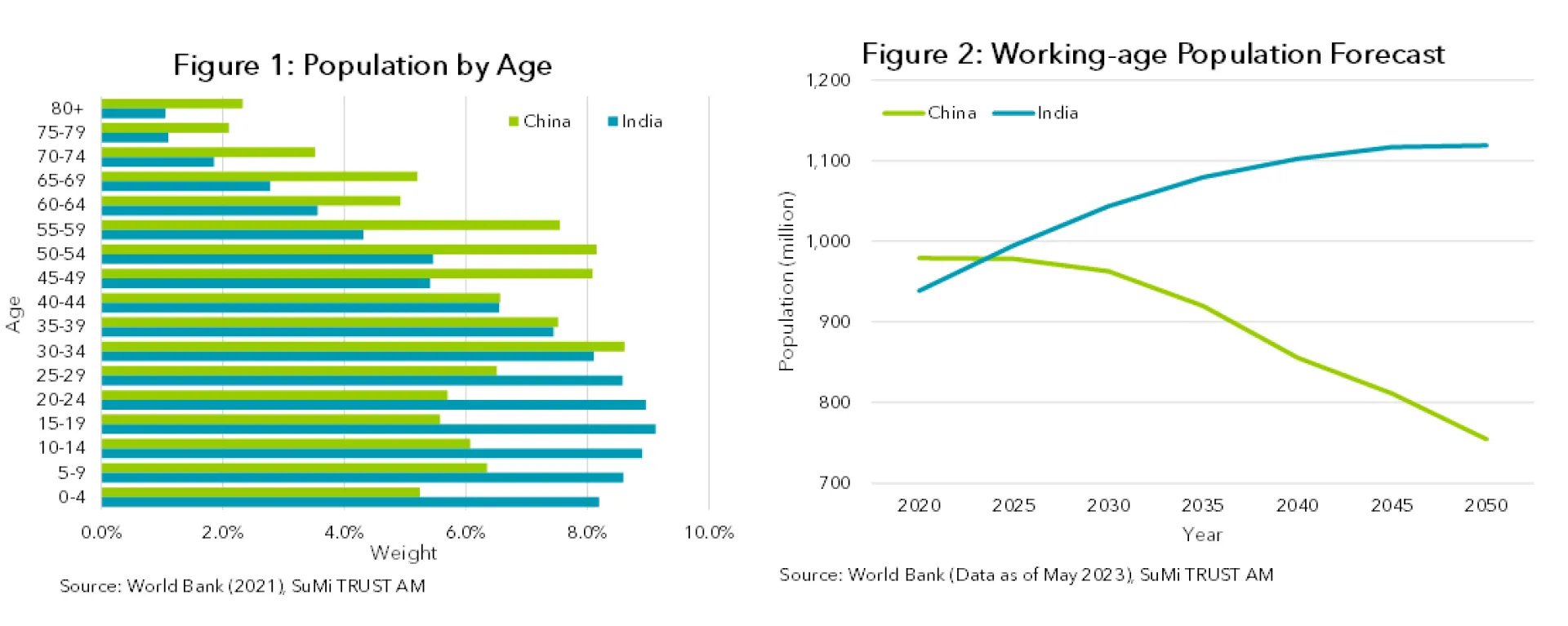

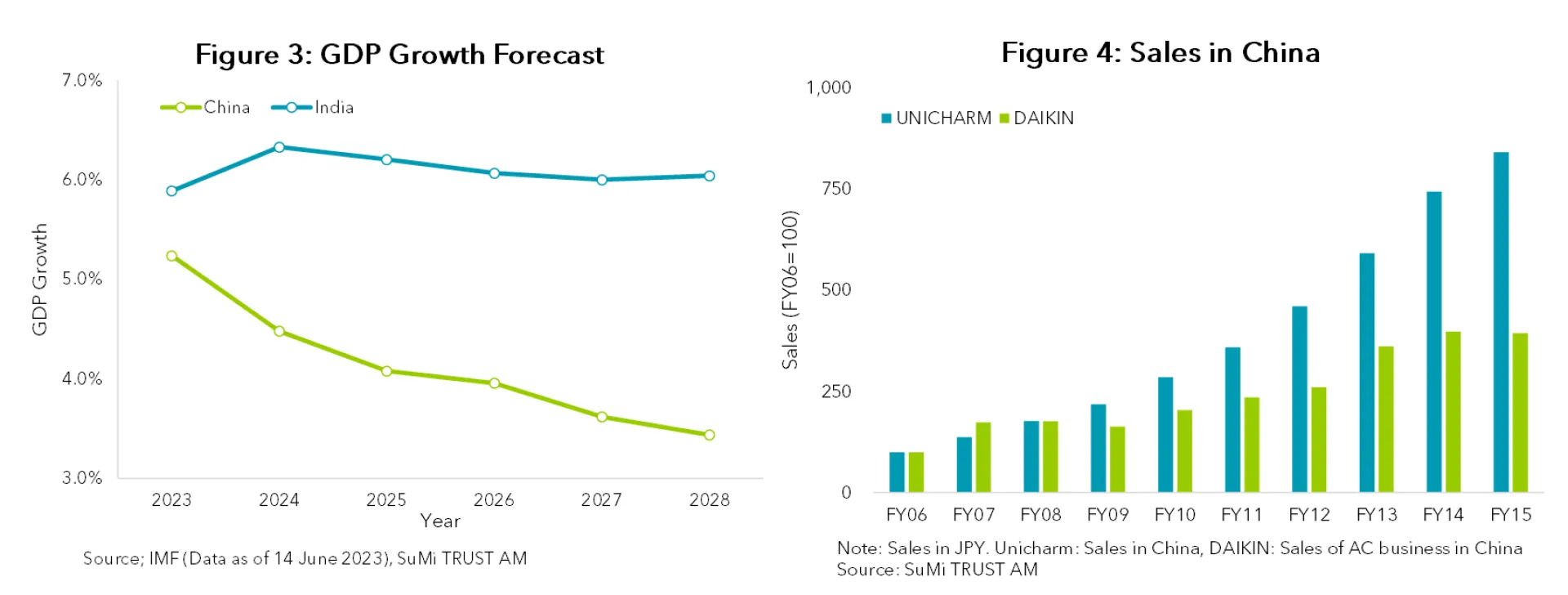

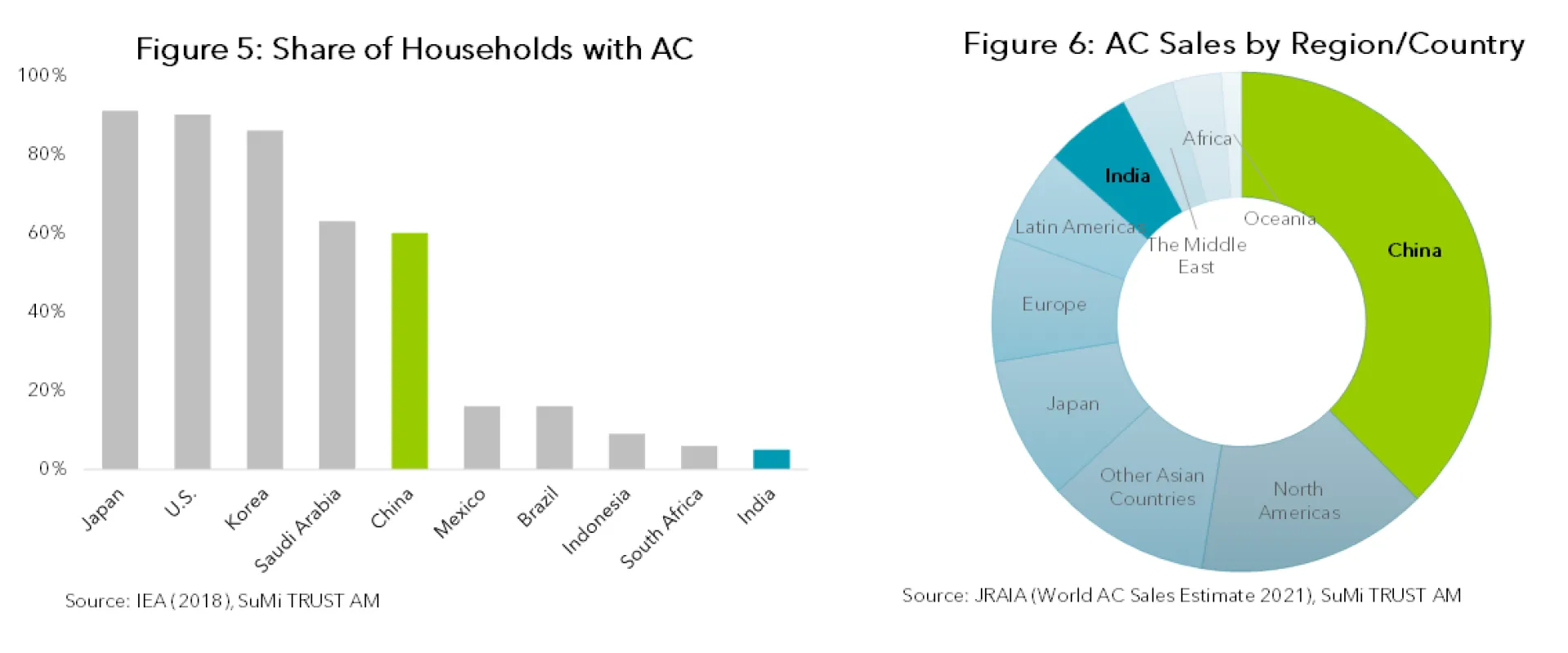

Although both India and China have populations of around 1.4 billion, the two countries are significantly different in various aspects. Most notably, demography and average income. Until recently China had long maintained the so-called “one-child policy” and as a result, the country is rapidly aging with 50-59 years of age being the largest age group (See Figure 1). On the other hand, India has a much younger population with those in their 10s and 20s making up the largest groups. An increase in the working-age population (i.e., a population between the ages of 15 and 64) is one of the most important drivers of economic growth. According to the World Bank, India’s working-age population will expand by 20% by 2050 while that of China has already peaked (See Figure 2). Against this background, it is expected that India’s GDP growth will be higher than that of China for years to come. (See Figure 3). It is also expected that India’s middle class will rapidly expand. GDP per capita, a proxy of national average income, in India is currently slightly above US$2,000 . Thanks to the expected strong growth, this will significantly increase.

As products and services provided by Japanese companies tend to differentiate by their quality rather than price, their businesses tend to expand in markets where the middle class is growing. The Chinese market is a good example of this - quite a few Japanese companies enjoyed strong growth in the 2000s and 2010s when China’s GDP per capita was around $2,000 similar to where India is now. In accordance with the rising GDP per capita in China, Japanese companies achieved rapid business expansion.

Figure 4 shows sales growth in China from 2006 to 2015 for DAIKIN and UNICHARM. DAIKIN produces air conditioners (AC) and UNICHARM provides consumer goods with focus on baby care and feminine care products. Their sales significantly grew during the period. DAIKIN achieved an annualised growth rate of 16% in the period and expanded the business almost four times. UNICHARM showed even stronger growth at 27% p.a. and its Chinese business multiplied eight times. I believe Japanese companies could realise similar growth in the Indian market in the coming years.

Investment Cases: Japanese Companies that are Well Positioned in India

Even though the Indian market offers business opportunities, it does not mean every company can expect success. As the saying goes ‘Rome was not built in a day’, businesses must put in the groundwork and spend time in the domestic market to build a strong foundation in order to succeed. Three Japanese companies I am going to introduce have spent years in India establishing robust business franchises and are ready to achieve secular growth.

My Japan Quality Growth strategy invests in companies managed by a capable management team that could achieve secular growth. I place a particular focus on the two aspects of a company - Growth Sustainability and Value Proposition – to determine the growth prospects of a company. Growth Sustainability is a potential market where a company expands by leveraging its existing Value Proposition. Value Proposition is added value a company provides to its client. I would love to see Value Proposition that is strong and hard to imitate. If a company has a potential market where it could expand its business by using its existing products/services, technology or business model, the company is highly likely to achieve secular business growth. In my portfolio, there are names for which I believe the Indian market is one of key drivers of Growth Sustainability.

1. DAIKIN INDUSTRIES (6367.T)

India’s Air Conditioner (AC) Market

According to the International Energy Agency (IEA), only a high single digit percentage of Indian households have ACs whilst the ratio is around 60% in China and 90% in Japan and South Korea (See Figure 5). As a result, while China, with its 1.4 billion population, already has the largest AC market in terms of number of ACs sold, the sales in India remain small (See Figure 6). The AC market steadily grows in tandem with an improvement of average income in a country. AC market growth tends to accelerate when its penetration rate reaches 10%. Given the current high single digit rate in India, I am confident that India’s household AC market is approaching an inflection point and will accelerate its growth from the mid-2020s. In fact, IEA, in 2018, expected that AC installation in India would grow tenfold from 26.6 million units in 2016 to 277 million units in 2031. The growth and scale of the market makes India one of the most attractive markets for investors.

DAIKIN in India

DAIKIN, one of the leading producers of ACs operating across the globe, has been in the Indian market for 10 years. It now has 10,000 sales and client services offices across the country, covering not only major cities but also local cities. Online and digital tools are deployed to support those offices. The AC producer has adequate production capacity for growth as it has established a new production facility in southern India in addition to its existing facility in northern India.

Thanks to its prior investments, DAIKIN has the largest market share in India’s commercial AC market. In addition, it has overtaken the market leader, VOLTAS, an India-based AC producer, in sales in the household AC market. This is partly due to the difference in their product offerings. VOLTAS mainly offers non-inverter ACs while DAIKIN sells inverter ACs. Whilst non-inverter ACs are more affordable, inverter ACs have various benefits including superior energy efficiency, a higher cooling capability and less noise. The Indian government has introduced an energy efficiency regulation that is another tailwind for DAIKIN’s inverter ACs. It is fair to expect a structural shift in demand from non-inverters to inverters in accordance with economic growth in India. This shift will help DAIKIN further increase its market presence in the country.

DAIKIN has made clear that India is one of its focus areas in its current mid-term plan. Its sales target for the fiscal year ending March 2026 is set at JPY 175 billion ($1.25 billion), up 50% from the previous fiscal year. On the back of the business franchise it has established in India and the competitive advantage of its products, DAIKIN will achieve sales growth faster than the market in India as it did in China. I believe the company will expand its AC business in India at 15%-20% annually and could reach to above JPY 500 billion ($3.57 billion) in the financial year ending March 2031.

2. UNICHARM (8113.T)

India’s baby care and feminine care markets

UNICHARM, a producer of feminine care and baby care products, entered into the Indian market 15 years ago. It has invested in the country to establish its business basis including production capacity and localised R&D (research and development) capabilities. These prior investments led to rapid sales growth in the country. The company stated that sales growth in India so far is faster than any other country it had entered. Its sales in India went up +44% year on year in 2022. Earnings turned positive in 2021 and grew considerably in 2022 although it remains relatively small.

Currently, the vast majority of UNICHARM’s revenue in the country comes from baby care products. It is the second largest player in the sector following P&G. The Japanese company anticipates its sales to grow faster than the sector and aims to overtake P&G. The feminine care sector, UNICHARM’s core business, is expected to accelerate its growth rate. In this sector, the company often enters the market later than its competitions and takes market share from them. I expect that its business will expand significantly given its limited market share in the sector at around 8% where P&G and Johnson & Johnson have 48% and 30% of the market respectively. I expect UNICHARM to double its sales in India by 2025-26 and maintain strong growth for the mid- to long-term.

3. SONY GROUP (6758.T)

India’s Media & Entertainment Market

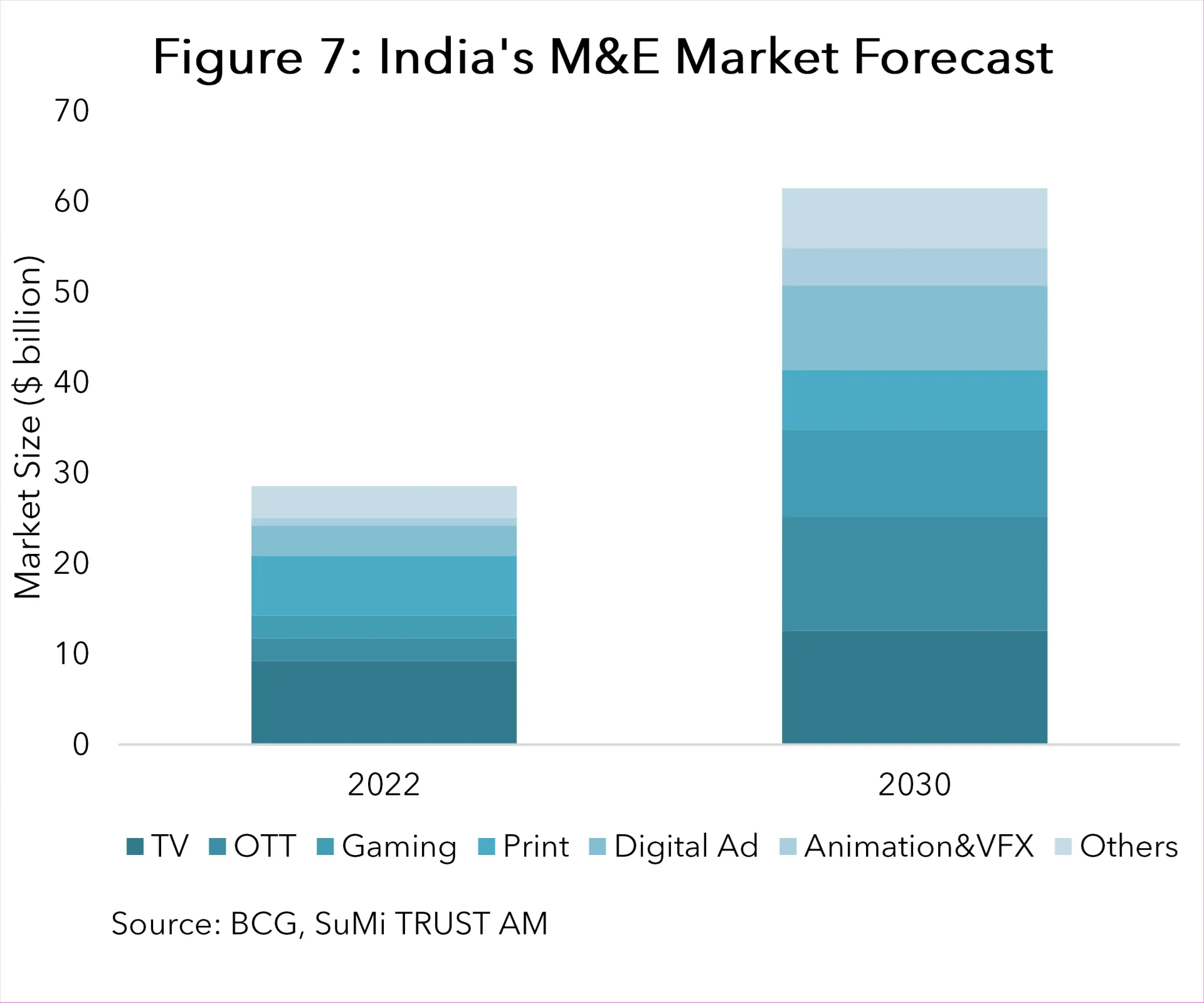

The Media & Entertainment (M&E) market is another market that posts a higher growth rate than the economy when the income level of a nation rises. India’s M&E market, which is currently at around $28 billion, is expected to grow by 10% in the coming years and reach $60 billion by 2030 (See figure 7). Within the M&E market, the OTT (Over the top), which includes SVOD (subscription video on demand), and gaming segments will post the fastest growth.

SONY in India

SONY GROUP, an electronic equipment and entertainment services provider, has been operating in India since the 1980s. Its business covers various sectors of the M&E market. SONY MUSIC ENTERTAINMENT INDIA has over 20% market share in India and SONY PICTURES NETWORK INDIA (SPNI) provides services to 700 million viewers. SPNI keeps investing in content creating capabilities. SPNI holds broadcast rights for major competitions of cricket, tennis and football. In 2021, SPNI agreed on a merger with ZEE ENTERTAINMENT, which provides an integrated content platform to 1.3 billion users in 173 countries. The SPNI-ZEE merger will add synergies to both the entities. While SPNI has strength in content in major languages, ZEE has a wide coverage of local languages in the multi-lingual country.

I am convinced that SONY will increase its presence in the fast growing Indian M&E market. In addition to SONY’s PlayStation in the gaming sector, its M&E business has substantial growth potential in India. Although SONY’s current sales in India are relatively small at around $2 billion, I believe its huge potential will materialise through the company’s strong commitment to the market. Kenichiro Yoshida, Chairman and CEO of SONY GROUP, spared time to introduce its business and growth strategies in India as one of its focus, at the Corporate Strategy Meeting in May 2023. N. P. Singh, CEO of SPNI, also made a presentation at the event , which left me with a strong impression that SONY is committed to its business expansion in India. With its strong commitment, I believe SONY will achieve secular and durable growth in the Indian market.