- Myth: Japanese companies are different from Western companies

Corporate Governance Improvement

Thanks largely to the corporate governance code and the stewardship code, both of which were introduced as part of Abenomics, Japanese companies are now managed better than in the past from the perspective of shareholders. For example, corporate governance practice in Japan has changed. According to the Tokyo Stock Exchange, Japanese listed companies are appointing an increasing number of independent external directors. External directors account for more than a third of the board of directors in over 90% of companies listed on the Tokyo Stock Exchange (TSE) Prime Market. It was less than 10% in 2014 just before the corporate governance code was introduced. One in every eight TSE Prime Market companies have a board with independent external directors that comprise the majority. For the JPX-Nikkei Index 400, a large to mid cap index of well governed and profitable companies, it is one out of six. Although the number is not very high, it has clearly been increasing. It was one in 70 companies in 2014 and one in 35 in 2017. The process to appoint directors has also changed. 84% of Prime Market companies have a nomination committee, of which over 90% have external directors who account for a majority. We believe that the change contributes to better decision-making at Japanese companies and closely monitors the CEO.

Increasing CEO Compensation

Another area of change is CEO compensation, which has been much lower in Japan than in other developed countries and has provided little in the form of long-term incentives. It is believed that poorly structured CEO compensation has attributed to Japanese companies not being managed to their full potential. It is still the case that CEOs of Japanese companies, on average, do not receive the same level of compensation as their Western peers and their compensation package tends to be heavily skewed to a fixed base salary in comparison with other countries. However, it is worth noting that corporate Japan is catching up with its peers on a gradual but steady basis.

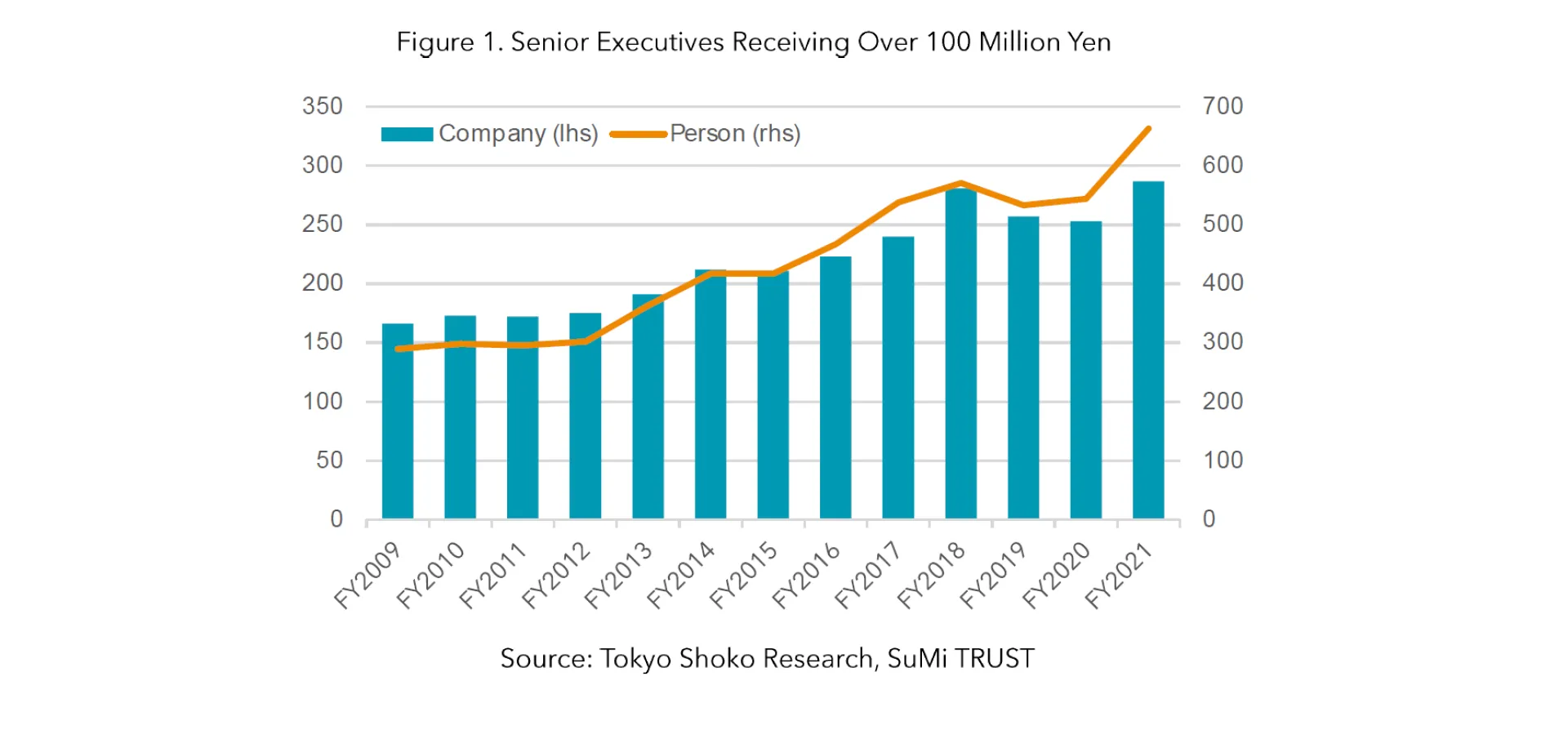

According to a survey by Willis Towers Watson (WTW), a CEO in the US receives an annual compensation of 1,530 million yen, and CEOs in the UK, Germany and France are paid 560 million yen, 670 million yen and 430 million yen, respectively. In contrast, CEOs at Japanese companies receive 180 million yen, which is almost a tenth of their US peers and around a third of European peers. However, CEO compensation in Japan is steadily growing. Since 2010, Japanese companies have been required to disclose names of senior management who have received more than 100 million yen. The number of highly paid executives has consistently been increasing and has doubled in 10 years (See Figure.1)

Better aligned interests between CEOs and shareholders

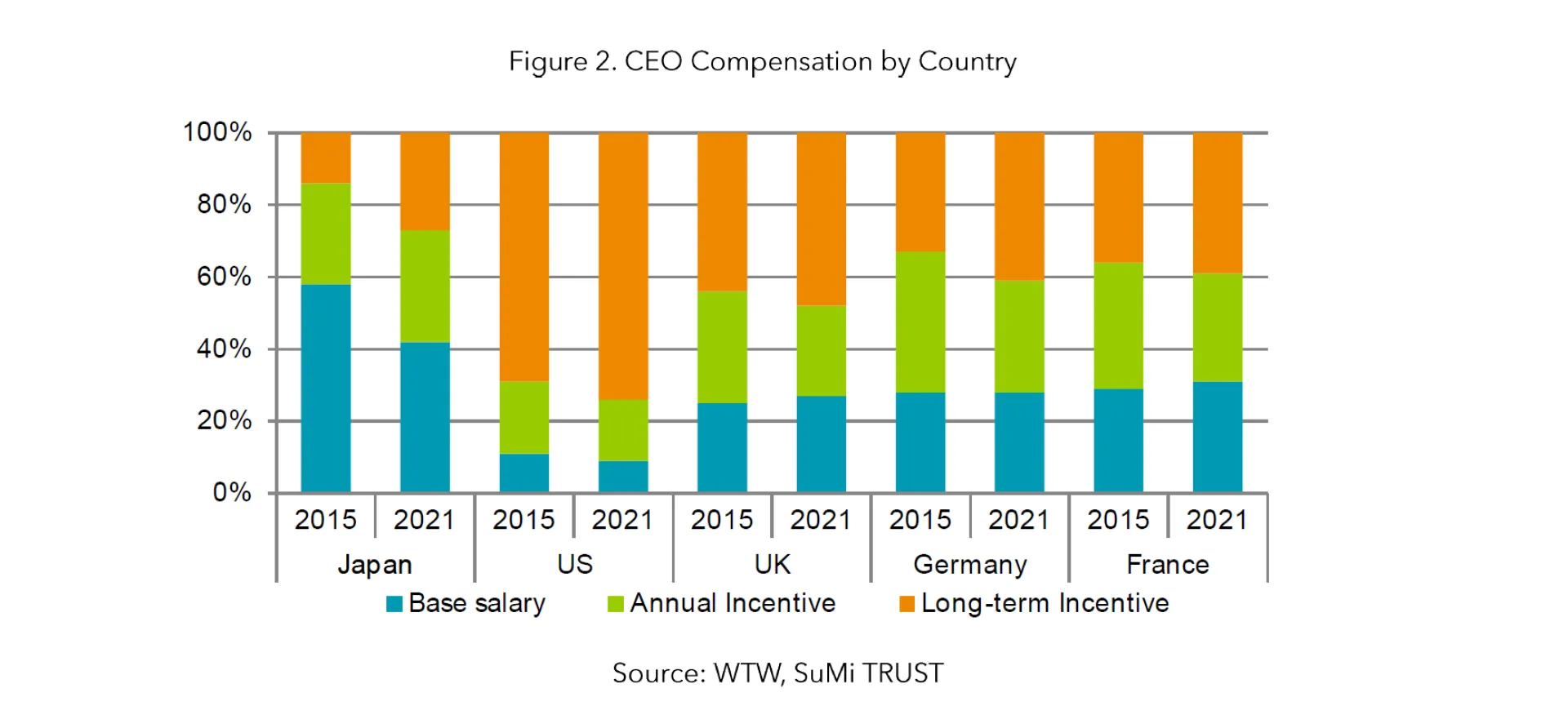

More importantly, the composition of CEO compensation in Japan has been catching up with European countries. A survey in 2015 showed that almost 60% of CEO compensation was fixed base salary in Japan whilst it was almost 30% at companies in the UK, Germany and France, and only 11% in the US. Long-term incentives accounted for only 14% in Japan, which was less than half of that in Germany, which had the second lowest long-term incentives portion among the five countries. It is obvious that this package did not incentivise Japanese CEOs to make bold decisions and to take risk aiming to increasing enterprise value. In 2021, base salary decreased by 16 points to 42% and long-term incentives almost doubled to 27% in Japan. Although the base salary still accounts for the largest portion and long-term incentives account for a smaller portion than in other countries, it is natural that the changes would push CEOs to be more serious about improving profitability. As long-term incentives are often linked to shareholder returns, such changes have made CEOs more aware of the interests of shareholders, which, in the past, gained little attention in Japan.

2. Tatsuya Suzuki on changes in Japanese companies

Tatsuya Suzuki, Chief Portfolio Manager of the Japan Quality Growth Strategy, introduces the changes in Japanese companies by answering questions from Akimichi Oi, Senior Investment Director.

-- You invest in companies with secular growth. Do you place emphasis on alignment of interests between its shareholders and senior executives?

Yes. I predominantly invest in companies that are managed by a management team that are on the same boat with shareholders. Alignment of interests between senior management including CEOs and shareholders can be achieved via compensation structure and the executives’ economic ownership in a company. The alignment leads to improving capital allocation often including higher dividend payouts and share buybacks, and higher awareness of human capital development and talent management, all of which are critical for better shareholder returns. Thus, I pay strong attention to equity ownership and the compensation structure of CEOs and senior executives.

-- Do you notice positive changes at Japanese companies?

Yes. I have seen changes for some years and those changes are gaining momentum. We launched the Japan Quality Growth strategy in 2015 when I was convinced that an increasing number of Japanese companies would achieve secular growth and generate solid shareholder returns over the mid- to long-term on the back of the implementation of the Corporate Governance code and Stewardship code. Through my research, I noticed signs of positive change at Japanese companies that increasingly focused on profitability improvement and long-term earnings growth and were keen to listen to shareholders. Companies have kept changing since then and have become more shareholder friendly. Such changes have gained momentum in the last couple of years. They are now built in to the system and I believe are irreversible.

-- What will be the impact from changes in CEO compensation in Japan?

The impact would be significant. As a long-term investor seeking secular growth, it is very important to have senior executives on the same boat as shareholders. Without strong conviction that senior executives of a company are highly capable and aim to grow its enterprise value as an agent of shareholders, it is difficult to commit long-term capital. A company managed by its founder clearly meets the criteria.

In fact, companies that posted strong returns in the long run are often managed by founders or have large shareholders on their management team. Examples include M3 (2413), Keyence (6861), Sysmex (6869), Cyberagent (4751) and Cosmos Pharmaceutical (3349) all of which are managed by founding families and posted 1,000%+ returns in the last 15 years. Among Japan’s largest companies by market cap, Fast Retailing (9983), SoftBank Group (9984) and NIDEC (6594) have been managed by founders and posted solid returns. I am sure that by properly incentivising senior executives, many companies could achieve such returns.

-- Do you prefer founder-managed companies? Or do you also see promising opportunities in companies not managed by large shareholders?

I have also observed exciting opportunities at companies not managed by large shareholders thanks partly to the changes at Japanese companies. In the past, I rarely had constructive discussions with the CEO of an old Japanese company on alignment of interests with shareholders. Now, it is an integral part of our discussion with CEOs. I am seeing a trend that an increasing number of CEOs of legacy Japanese large-cap companies have meaningful economic exposure to their companies and are on the same boat as shareholders. This is a drastic change. For instance, Mr Yoshida, CEO of Sony Group, owns over 3 billion yen in company shares and Mr Kakiuchi, Chairman of Mitsubishi Corporation, holds over 2 billion yen in shares. A company that implements a compensation structure incentivising its management team to generate shareholder returns is likely to realise its potential. Given that a large number of Japanese companies have competitive products/services and unique technologies, placing senior executives on the same boat as shareholders could bring superior opportunities to investors. I believe those changes are structural and are a long-term theme in Japan and could offer attractive opportunities to active investors.

-- Do you expect any associated opportunities brought on by changes in companies?

When senior executives are better incentivised and aim for faster business expansion, there should be increasing demand for professional services that contribute to growth. Technology companies that contribute to streamlining or transforming client businesses is an example. Another area is HR-related services. When you focus on the secular growth of your company, you need talent. In Japan, it has been typical to fill positions by internal transfers. But, if you want to hire the best candidate, you need to look beyond your organisation and sometimes beyond your industry. Since CEOs are increasingly aware of the importance of human capital development and talent management, demand for quality recruitment services is increasing. I like Visional (4194) in this area. Its direct recruiting platform, Bizreach, can differentiate itself from its peers by providing companies with access to a broad universe of capable workers. The service is better positioned in the industry than traditional recruiting agents to benefit from the changes of Japanese companies.

-- Are the senior executives at Visional “on the same boat” as you?

Yes. Mr Minami, CEO of Visional, is the founder of the company and owns 45% of its shares. Its senior management team is also among the largest shareholders of the company. I am confident that the team is in the same boat as its shareholders.

Please note this letter is for information purposes only and should not be regarded as advice or a personal recommendation.