Real GDP growth in the April-June quarter is expected to be around 0%, as domestic demand is likely to remain stagnant, mainly due to the impact of the declaration of the third state of emergency, although exports are likely to remain strong as overseas economies recover. However, if the vaccination rollout progresses, the Japanese economy is expected to recover due to a pick-up in personal consumption, etc.

Progress in Japan's vaccination programme has been slower than in other major countries, but progress is now being made. The outlook for vaccine supply has been confirmed, and measures are being taken to secure medical personnel and other vaccinators. According to a survey of municipalities across Japan, more than 90% of the elderly (aged 65 and over) are expected to have been vaccinated by the end of July. The pace of vaccination in early June has risen to over 500,000 people per day. If the pace accelerates to the government's target of vaccinating the elderly by the end of July (1 million people per day), the vaccination rate required to achieve herd immunity (about 70% of the population) could be reached by the end of this year. In countries that are ahead of Japan in vaccination, the number of infections has remained stable even as restrictions on activity have been relaxed, suggesting that vaccination is effective in controlling infection.

2. Exports

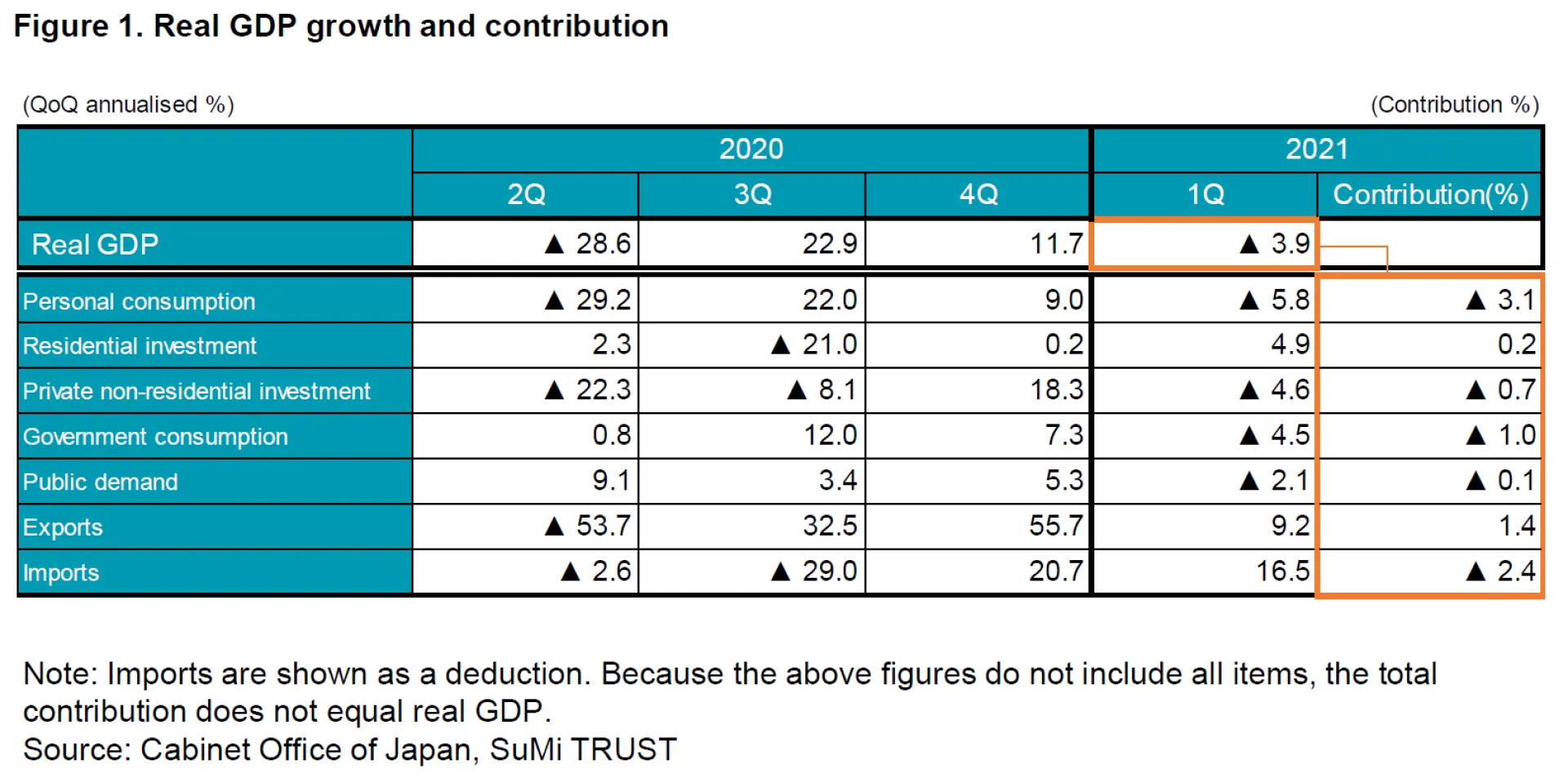

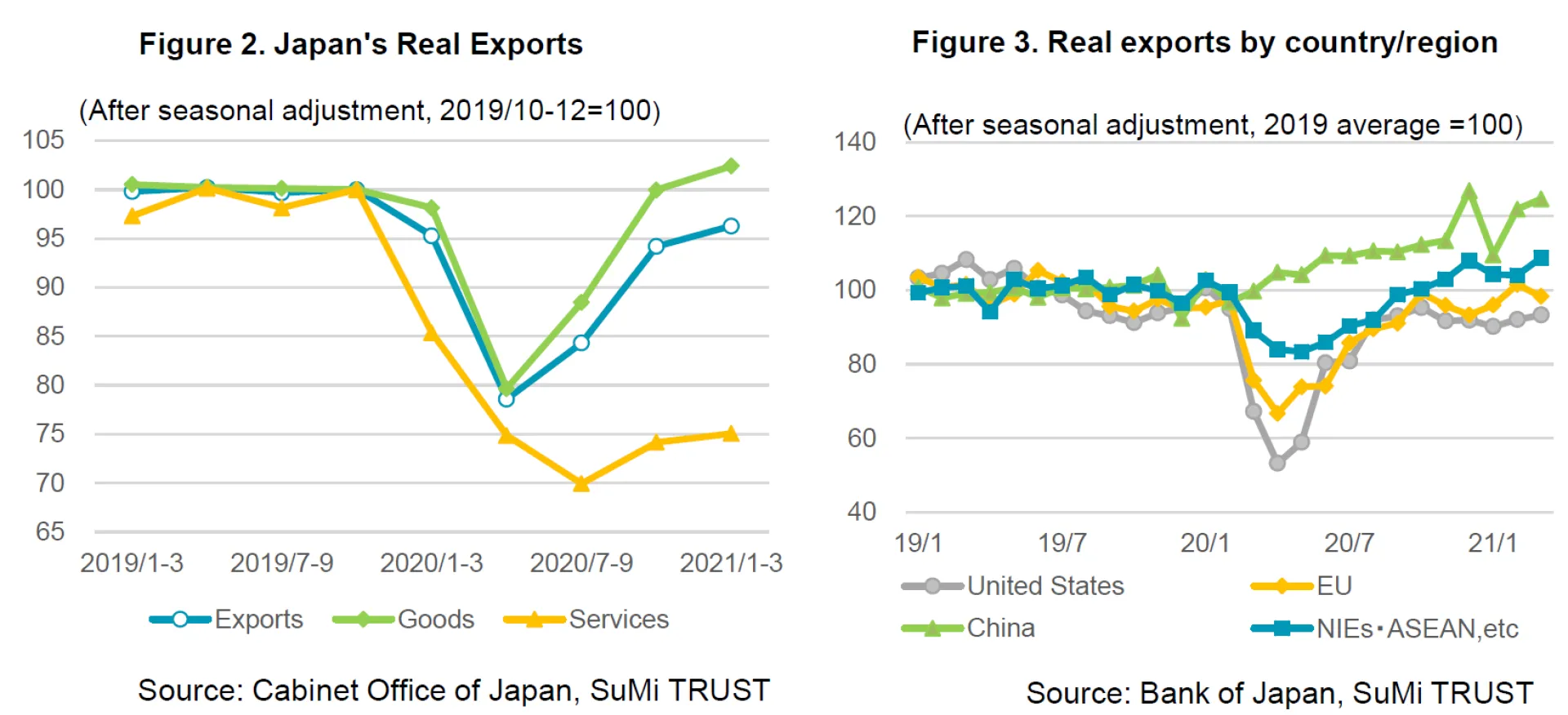

Exports grew at a QoQ annualised rate of +9.2% in the January-March quarter of 2021 and are on an upward trend. Goods exports to China led the way in the fiscal year 2020, but with the US economy recovering at an accelerating pace, exports to the US and intermediate goods exports to Asia and other countries with final demand in the US are expected to increase in the future. In trade statistics for April, real exports rose to a record high level. Although there are concerns about the impact of supply constraints in the automotive and other sectors due to the current global shortage of semiconductors, goods exports are expected to remain strong on the back of a recovery in overseas economies as a result of progress in the vaccination programme. As for services exports, they remain sluggish mainly due to a decline in consumption by inbound tourists. Even if Japan's vaccination programme makes progress, it is unlikely that travel restrictions will be eased unless the spread of the virus is under control globally. Compared to goods exports, the recovery of services exports will be slow, with a full recovery not expected until after fiscal year 2021.

3. Personal consumption

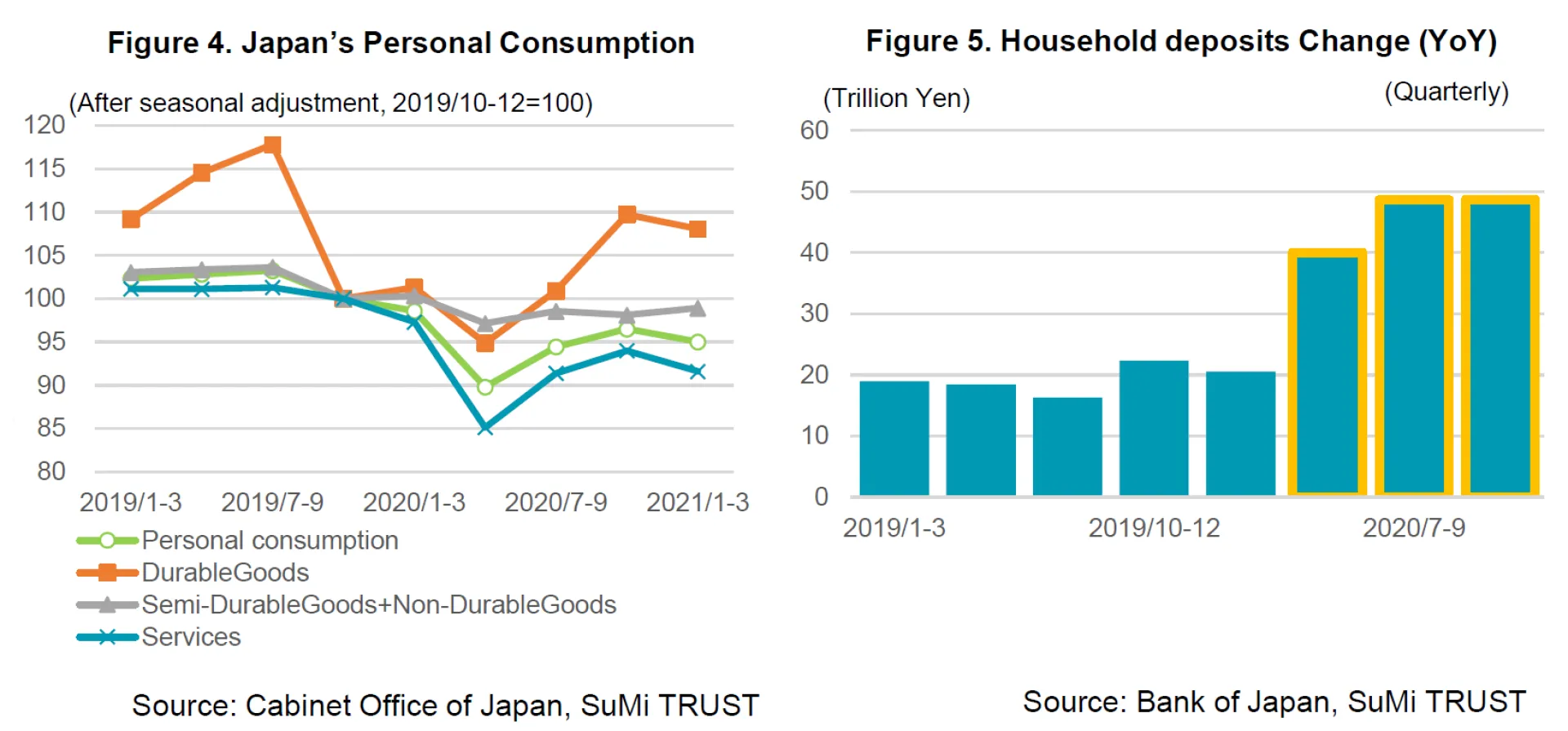

Personal consumption fell at a QoQ annualised rate of -5.8% in the January-March quarter of 2021, and is expected to stagnate in the April-June as a result of the third state of emergency declaration. In the meantime, the amount of household savings has increased significantly, as a result of the reduction in consumption, particularly of services such as eating out and travel, and receiving of government benefits. Therefore, we expect that restrained service consumption will start to pick up in the second half of this fiscal year as the vaccination programme progresses and the risk of infection declines. Although it is generally considered that pent-up demand for services consumption is unlikely to be realised, the resumption of the “Go to campaign”, a subsidy for eating out and travel, at the right time, for example, could lead to an increase in travel and other spending. Although wage increases are expected to have been limited to a limited number of companies this year, personal consumption is likely to remain robust as companies increase wages and employment once the coronavirus is under control.

4. Private non-residential investment

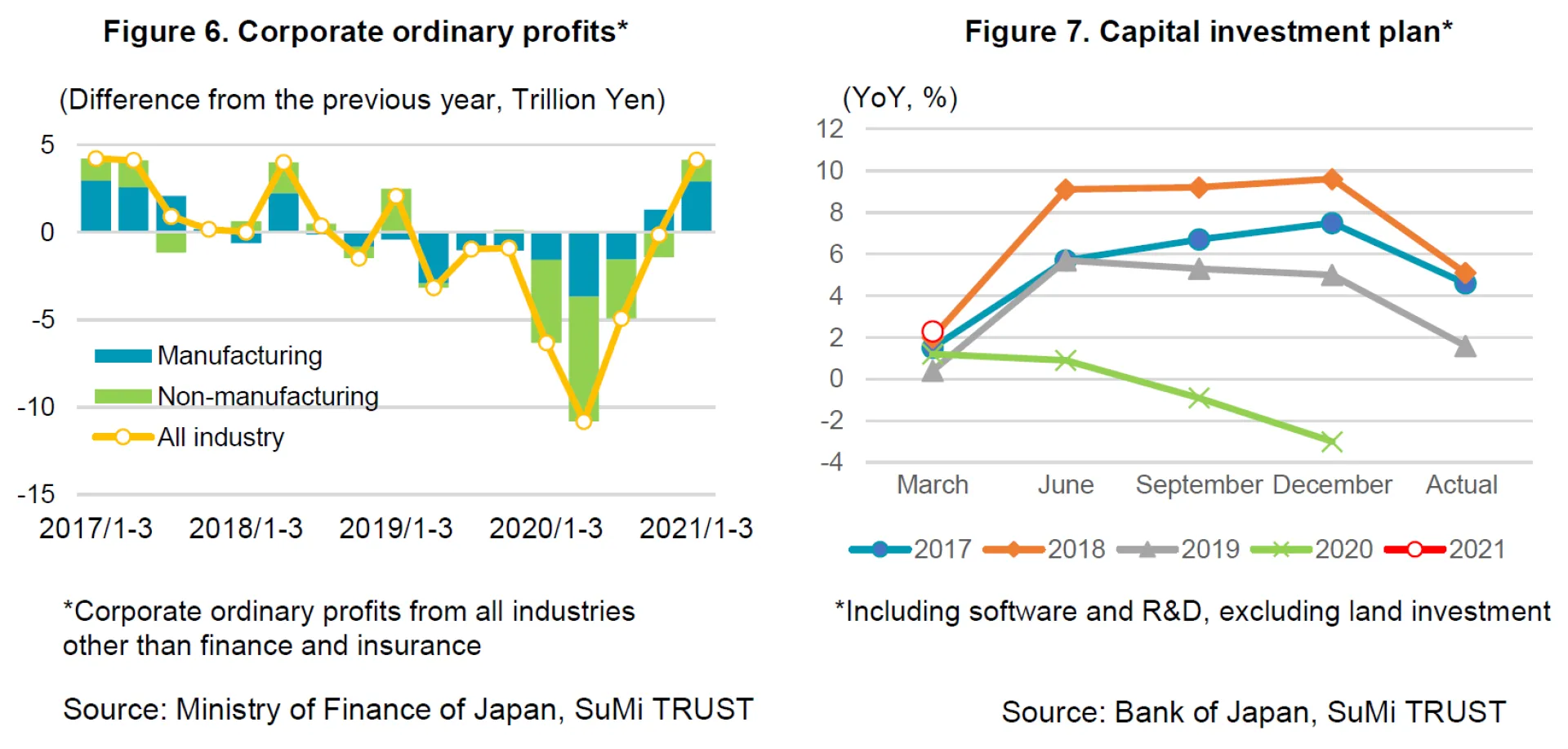

Private non-residential investment fell at a QoQ annualised rate of -4.6% in the January-March quarter of 2021, partly as a rebound from the high annualised growth rate of +18.3% in the October-December quarter of 2020. Looking ahead, we expect private investment appetite to improve on the back of recovering corporate profits and strong exports, and a gradual resumption of investment that has been deferred, particularly in machinery and digitalisation-related investment in the manufacturing sector. The Bank of Japan's Tankan survey of March 2021 showed that capital investment plans for fiscal year 2021 were +2.3% compared to the previous year, which was stronger than usual for the same period due to the rebound from fiscal year 2020.

5. Public demand

Public demand was negative for the first time in ten quarters, mainly due to a decline in government consumption. However, government consumption is expected to increase in the coming months due to the impact of vaccination costs, the recovery of medical attention, and the resumption of the "Go to Campaign”, a subsidy for eating out and travel, after clear evidence of infection control. A total of about 3 trillion yen has been allocated for the "Go to Campaign", of which about 2 trillion yen excluding about 1 trillion yen already spent is expected to boost government consumption when the campaign resumes.

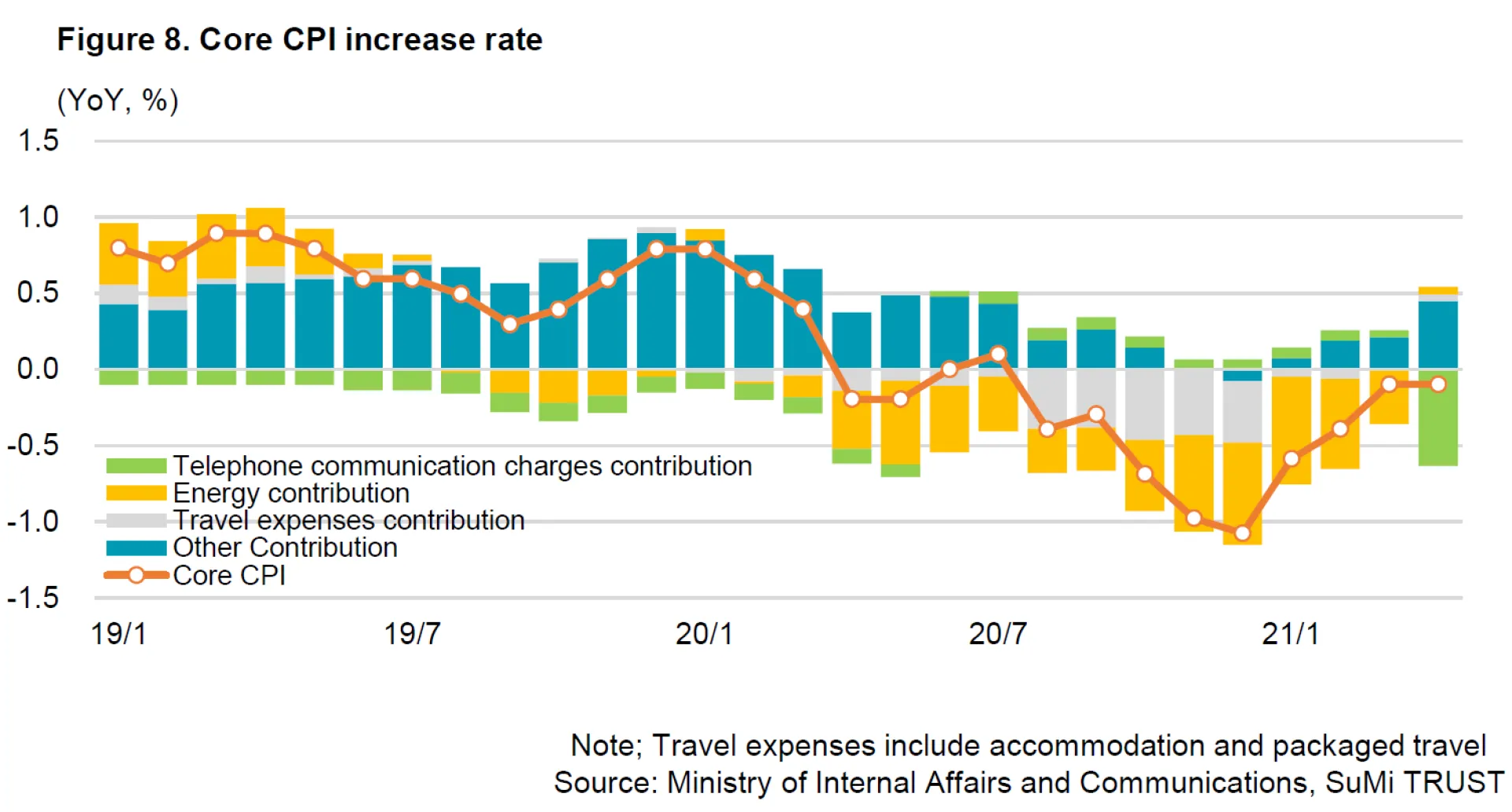

6. Consumer prices

With regard to the Core CPI, the reduction in mobile phone tariffs is expected to push down the rate of increase in the CPI significantly this fiscal year. On the other hand, energy prices turned positive on a year-on-year basis in April, following a sharp rise in crude oil prices since last year, and energy is expected to continue to push up the CPI. In addition, the Core CPI is expected to increase towards the end of the year, partly due to the rebound from the significant fall in travel prices caused by the "Go to Travel Campaign", a subsidy for travel, in the previous year, and partly due to the increasing pressure on prices from the pick-up in consumer demand. However, against the backdrop of Japan's prolonged period of low inflation, the expected inflation rate is unlikely to rise, and a sustained rise in prices accompanied by an increase in wages will not be achieved, and the Bank of Japan's target of 2 percent is expected to remain far from being achieved.

7. Key points for the future

The biggest factor to the outlook for the Japanese economy is the progress of the vaccination programme. There is a certain degree of downside risk depending on whether the Government/municipalities can secure enough number of the medical staff to administer the vaccinations. In addition, the normalisation of the economy is likely to be delayed in the event of a delay in the establishment of a vaccination system or the spread of new variants of the virus in Japan. However, given the Government's target of completing the vaccination of the elderly by the end of July, the pace of vaccination is expected to accelerate. Despite the initial confusion related to vaccination appointments, once the vaccination system is in place and stable, it is likely that the timing of the economic normalisation will be brought forward.