Steady growth is expected supported by capital investment and private consumption

In 2022, the environment surrounding Japan‘s economy changed dramatically, with JPY depreciating sharply against the U.S. dollar, Russia’s invasion of Ukraine, and price increases at levels not seen in 40 years. COVID-19 continued to spread and be contained, however, as vaccinations progressed and the number of severe patients declined, the government changed its focus from prevention measurement to economic activity revitalisation. In October the border restrictions to enter the country were greatly relaxed and foreign tourists started coming back. In the United States, the interest rate was raised in response to huge inflation, while Japan maintained its ultra-easing monetary policy though Japan’s CPI surpassed BOJ’s target inflation rate of 2%. As a result, the interest rate gap between Japan and the US widened, and JPY depreciated significantly against the US Dollar. In addition to the JPY depreciation, rising commodity prices triggered by Russia’s invasion of Ukraine accelerated inflation, and both Japanese companies and consumers suffered from the cost increase. On the other hand, the foreign-demand manufacturing industry benefited from weaker JPY, contributing to firm corporate earnings overall.

In 2023, the Japanese economy is expected to follow a moderate expansion trend, underpinned by capital investment and private consumption driven by the resumption of economic activity from COVID-19 pandemic, despite concerns for the global economic recession. There is a possibility to overcome deflation if we can see sustainable wage growth.

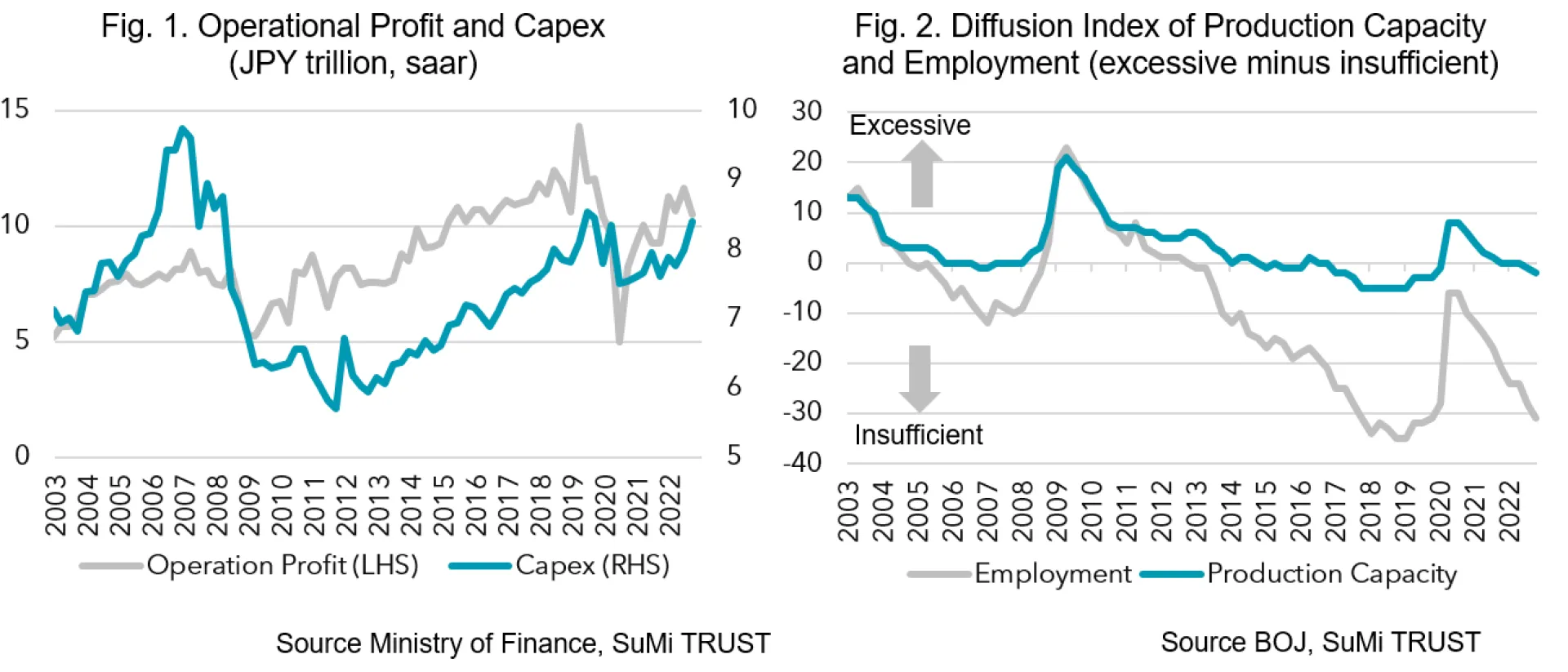

Capital investment was increased in 2022 following the stagnation from 2019 to 2021(Fig. 1). We understand that the impact of the slowdown in global economic growth is unavoidable, but given the pent-up demand for capital investment, which had been suspended due to supply constraints such as semiconductors, and the growing sense of shortages in production facilities and the labour force (Fig. 2), as well as the expected record high level of profits for Japanese companies in FY2022, there is room for companies to make investments. Therefore, we believe that capital investment will continue, especially investment to address unavoidable issues in the medium to long term, such as those related to digital transformation.

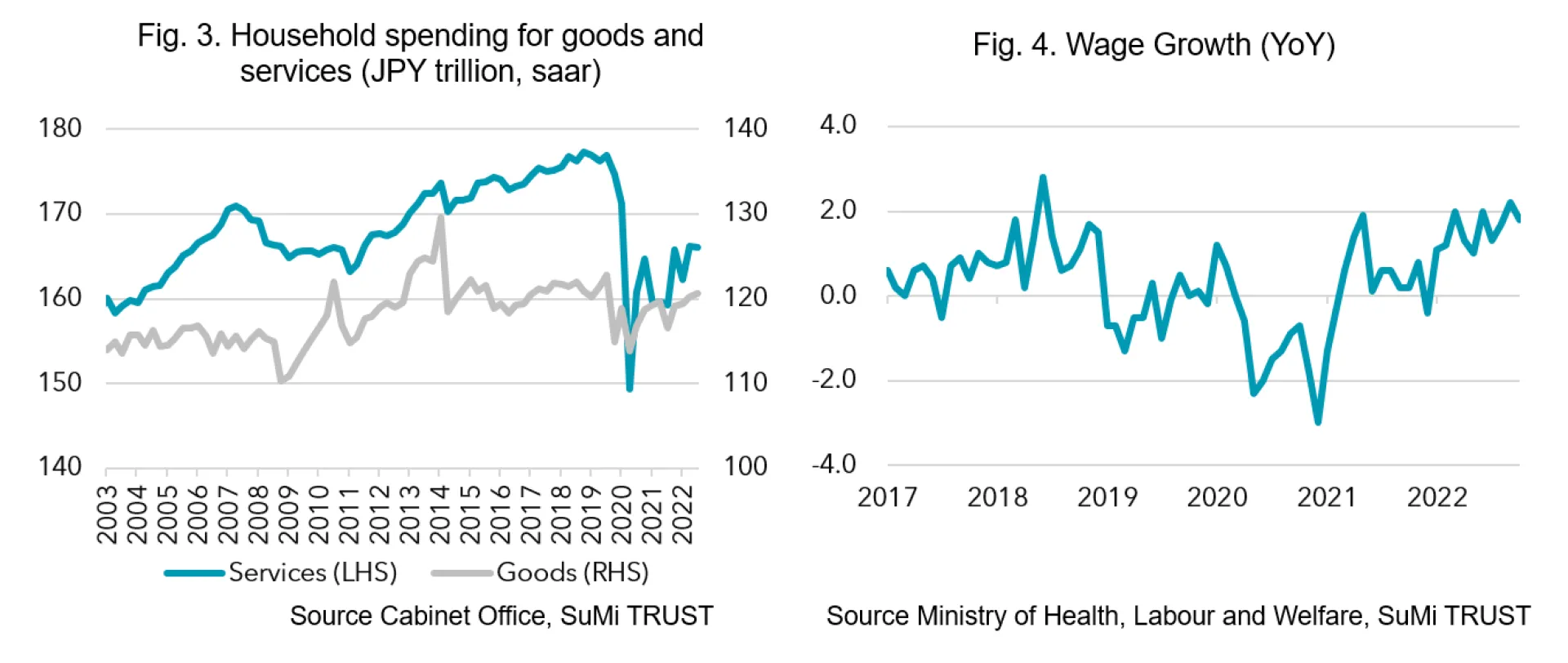

The private consumption is expected to recover, lagging behind that of the US and Europe for 6 to 9 months, supported by pent-up demand from the COVID-19 pandemic. Consumption has not yet returned to pre-pandemic levels, and there is considerable room for recovery, particularly in demand for services, which was severely impacted by COVID-19 (Fig. 3).

With the recovery in service consumption, the tightening of the labour market is expected to accelerate due to labour shortages, which were observed even before the pandemic, and wages are expected to continue to increase moderately (Fig. 4). The Japanese Trade Union Confederation, known as “Rengo”, is requesting a wage increase of 5% for the FY2023. The corporate earnings of Japanese companies in FY2022 are expected to reach a record-high level, and the firms have considerable room to raise wages. The wage level for the next fiscal year will be decided in March to April, and we expect wage increases to exceed the inflation rate.

Possible monetary policy change under the new BOJ governor

The BOJ will continue the ultra-easing monetary policy albeit with a change in the long-term interest rate, until it achieves a sustained price increase of 2%. The modification of the Yield Curve Control announced in December 2022 was a fine-tuning aimed at encouraging a smooth formation of the entire yield curve. Although the current core CPI is over 3%, the BOJ's price outlook for the next year is at a level below 2%, and it is unlikely that policy interest rate changes will be made during the term of Governor Kuroda's office, which will end in April 2023.

From April onward, the new governor will focus on the growth of real wages to change its monetary policy. If wage increases exceed the inflation rate, a virtuous cycle in prices will be in place, and the BOJ's view of a sustainable 2% inflation will be evident. Although we do not expect it to be highly probable at this stage, there is a possibility that discussions on the monetary policy change may begin in late 2023. The BOJ recognises the side effects of the ultra-easing monetary policy but in the meantime, the Bank also understands the significant impact on the financial markets when the monetary policy is drastically changed, as it has since Governor Kuroda was appointed in 2013. We believe that a thorough dialogue with the market will be conducted before the implementation.

Monetary policy in the US and Japan will continue to be the main factor that influences the FX market

In 2022, JPY depreciated sharply against the US Dollar against the backdrop of the widening interest rate gap between Japan and the US, and we expect the interest rate will continue to be the main factor that influences the foreign exchange market in 2023.

The December FOMC narrowed Fed's rate hike to 0.50% from 0.75%, clarifying the slowdown of the pace of the rate hike. Although the interest rate gap will continue to widen for the time being as interest rate hikes continue, it seems the market has discounted the ceasing of the interest rate hikes, and investors are focusing on whether Fed will cut the interest rate due to the recession in the future. As a result, JPY is expected to remain in the range of 120 to 140 to the US dollar in 2023, reflecting heightened pressure for a stronger JPY resulting from the narrowing of the interest rate gap.

Expected to outperform other developed markets

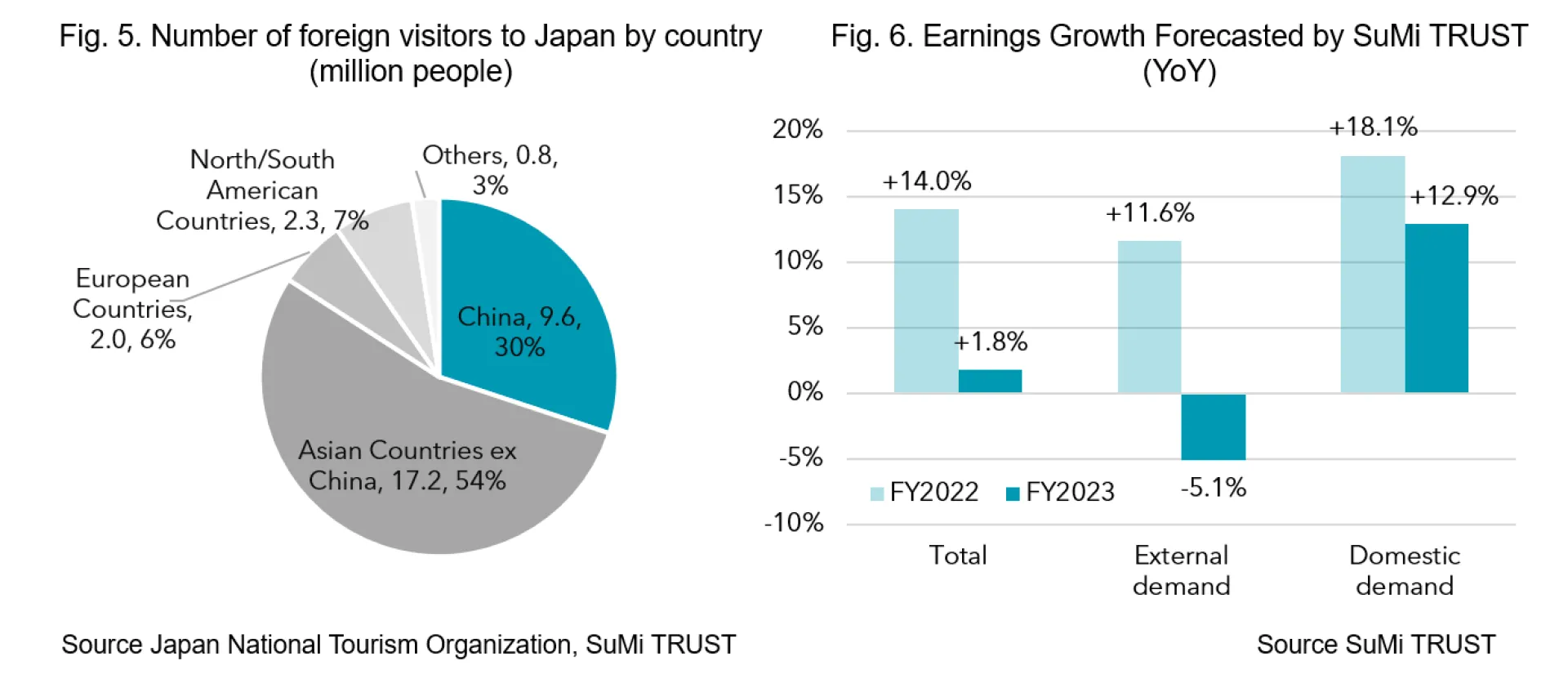

In 2023, there are concerns about a deterioration in economic conditions in developed countries. In Japan, on the other hand, earnings are expected to be firm, especially in the domestic-demand oriented industry, due to pent-up demands and an increase in inbound tourists through the relaxation of border measures.

In terms of inbound tourists, as zero-COVID policy in China, where over 30% of the total tourists came from in 2019 (Fig. 5), remains, we expect tourists from Asian countries other than China are expected to visit Japan in advance the Chinese tourists, and from the latter half of next year, with the addition of Chinese tourists, it will enter a full-fledged recovery phase.

As for external-demand oriented industries, they will face headwinds due to the global economic slowdown as well as JPY appreciation, but resolving supply-chain disruption, especially improvement in the supply of semiconductors, will support the production of the manufacturers.

According to our forecast for the Nikkei 225 stocks as of December 2023, we expect that non-manufacturers will post double-digit earnings growth in both FY2022 and FY2023 whilst earnings growth of manufacturers in FY2023 will be slightly negative. As we assume that inflation and cost increase will continue in 2023, we also forecast that earnings disparities among companies will widen depending on their pricing power and resistance to the cost increase. Under such a situation, stock selection will be a more essential factor of the investment.

The Nikkei 225 will hover around in the range of 28,000 to 32,000 in 2023. The key focus of investors will be the shift in the US monetary policy. If the Federal Reserve cuts interest rates in the latter half of the next year, it will boost the index to rise.

Risk factors

Risks include a significant slowdown in China's economic growth, a prolonged military confrontation in Ukraine and excessive JPY appreciation.

Since the protest demonstration against the "Zero COVID Measure" in China, we expect the Chinese government will gradually relax the preventive measures against COVID. Whilst production activities and consumption have been heavily impacted by the restriction, it is difficult for the government to ease the restrictions as the infection numbers have been increasing. It is not easy to achieve economic growth at pre-pandemic levels within a short period of time. We are also concerned that Xi Jinping does not have an important aide who is familiar with the economic measures.

As for the military confrontation in Ukraine, 10 months have passed since Russia's invasion of Ukraine, but there are no signs of a settlement. If this situation is prolonged, it is anticipated that the European energy problem will worsen further, which will lead to soaring energy prices, rising concerns about inflation, and a negative impact on earnings for Japanese companies.

Regarding JPY, if the BOJ revises its ultra-easing policy, there is a possibility that JPY will appreciate significantly. It is also assumed that the volatility of the foreign exchange market will increase since it will be the first policy turnaround after the start of the monetary easing in 2013.